How to Organize a Successful Community Yard Sale

Hosting a community yard sale is a great way to connect with neighbours, clear out unwanted items, and make a little extra cash. Whether you live in a tight-knit neighbourhood or a growing subdivision, organizing a yard sale together creates a fun, collaborative event that benefits everyone involved. Here’s how to pull it all together.

1. Gauge Interest in Your Community

Before setting a date, talk to your neighbours to see who’s interested. A group chat, a community Facebook group, or a simple door-to-door flyer can help spread the word and get a sense of numbers. The more participants, the better the turnout!

2. Pick a Date (and Rain Date!)

Choose a weekend date with enough time to prepare and promote. Saturday or Sunday mornings are usually best. Be sure to select a backup rain date in case the weather doesn’t cooperate.

3. Get the Word Out

Promotion is key! Here are a few ways to market your event:

-

Create a Facebook event and share it widely.

-

Post on local buy & sell or community groups.

-

Use posters and signs around the neighbourhood and at major intersections.

-

Add your sale to online directories like Kijiji, Craigslist, or community calendars.

Encourage participants to spread the word too!

4. Make a Map or Address List

If your neighbourhood is spread out, create a simple map or list of participating homes so shoppers can plan their route. You can print copies or share a digital version in your promotional posts.

5. Plan for Traffic and Signage

Good signage helps people find your sale! Use bold arrows and large lettering to direct shoppers. You might also want to assign volunteers to help with parking if space is limited.

6. Help Each Other Prepare

Share tips on pricing, display, and setup with your neighbours. Consider pooling resources like tables, change float, or even offering a central table for kids to sell lemonade or baked goods.

7. Make It Fun

Turn the yard sale into a mini event! Play music, offer snacks, or invite local vendors or food trucks to set up. This helps draw a bigger crowd and creates a festive atmosphere.

8. Plan for Leftovers

Encourage everyone to donate unsold items to a local charity or arrange a pickup with a donation service. That way, everyone goes home lighter — and with less clutter.

A community yard sale is more than just a chance to declutter — it’s a fun way to meet your neighbours, create connections, and build a stronger community. With a little planning and teamwork, your yard sale can be a highlight of the season!

Quick & Clever Cleaning Hacks for Busy Families

Let’s face it—between work, school, sports practices, and trying to get dinner on the table, cleaning the house can feel like an impossible task for busy families. The good news? You don’t need to spend hours scrubbing to keep your home feeling fresh and functional. These smart cleaning hacks are designed to save time and help your whole family pitch in.

1. Make Cleaning Part of the Routine

The easiest way to keep mess under control is to build small cleaning tasks into your daily routine. Try these time-savers:

-

Wipe bathroom counters while brushing your teeth.

-

Clean as you cook to avoid a mountain of dishes.

-

Set a timer for a daily 10-minute tidy-up with the whole family.

2. Use Baskets for Fast Decluttering

Keep a basket in each main room of the house. When clutter starts to pile up—random toys, books, or socks—just toss them in the basket. At the end of the day, each family member can take their basket and return items to their proper places.

3. Put Your Dishwasher to Work

Your dishwasher can clean more than just dishes. Toss in plastic toys, range hood filters, toothbrush holders, and even baseball caps (top rack only!). Just be sure the items are dishwasher-safe.

4. Keep Cleaning Supplies Where You Use Them

Instead of storing all your cleaning products in one spot, keep a small caddy of essentials (multi-surface spray, microfibre cloths, etc.) in each bathroom or level of the house. You’re more likely to do a quick clean-up if the supplies are right there.

5. Invest in Time-Saving Tools

Robot vacuums, spray mops, and handheld vacuums can be game-changers for keeping floors and surfaces clean with minimal effort. Even kids love using them—win-win!

6. Teach Kids Simple Tasks Early

Even toddlers can help with easy chores. Make it fun! Use a chore chart or reward system to motivate them. Ideas for age-appropriate tasks:

-

Toddlers: Pick up toys, put dirty clothes in the hamper.

-

School-aged kids: Make beds, wipe counters, sweep.

-

Teens: Load/unload dishwasher, vacuum, clean bathrooms.

7. Do a “Laundry Load a Day”

Rather than letting laundry pile up for the weekend, try doing one small load a day—from wash to fold to put away. It makes the task feel more manageable and prevents laundry mountains from taking over your weekend.

8. Use Dryer Sheets to Dust Baseboards

This little trick saves time and keeps dust away longer. Dryer sheets not only remove dust but also leave behind a static-resistant coating, so dirt doesn’t settle as quickly.

9. Make Cleaning Fun with Music or Podcasts

Turn on a fun playlist, podcast, or audiobook and turn cleaning into a “me-time” activity—or a dance party for the whole crew.

10. Don’t Aim for Perfection—Aim for Progress

Your home doesn’t need to be magazine-perfect. The goal is to make life feel a little more organized and a little less stressful. Some days, doing the bare minimum is more than enough.

Keeping a clean home when you’ve got a full calendar and busy kids is no small feat—but with a few clever shortcuts and the right mindset, it’s totally doable. Remember: it’s about progress, not perfection. And with the whole family pitching in, you’ll spend less time cleaning—and more time enjoying the people you share your home with.

Essential Summer Festivals in and Around Peterborough, Ontario

Summer in Peterborough and the surrounding Kawarthas is nothing short of magical. With its stunning lakeside views, warm community spirit, and vibrant arts and culture scene, the region comes alive with festivals that celebrate music, food, creativity, and connection. Whether you’re a lifelong resident or visiting for the season, these festivals offer something special for everyone.

Kawartha Craft Beer Festival

📅 Dates: June 6–7, 2025

📍 Location: Del Crary Park, Peterborough

💵 Admission: Ticketed

Beer lovers rejoice! The Kawartha Craft Beer Festival is the perfect way to kick off the summer season. With more than 15 local breweries and cideries offering samples, plus live music, lawn games, and tasty bites from food vendors, it’s a lively and social event in a picture-perfect waterfront location. This festival is a fantastic opportunity to explore Ontario’s booming craft beverage scene in a fun, relaxed setting.

Kawartha Yarn & Fibre Festival

📅 Date: June 14, 2025

📍 Location: Fenelon Falls Community Centre

💵 Admission: Ticketed

Calling all crafters and fibre artists! This one-day event brings together over 75 vendors offering yarn, roving, spinning supplies, handmade goods, and more. Visitors can explore vendor booths, enjoy hands-on demonstrations, and connect with other creatives. The festival also supports start-up businesses and indie dyers with a “mini-market” section. Whether you’re a knitter, spinner, or just love handmade textiles, this event is a cozy, colourful treat.

Peterborough Musicfest

📅 Dates: June 28 – August 16, 2025

📍 Location: Del Crary Park, Peterborough

💵 Admission: Free

Peterborough Musicfest is a true summer staple. This free concert series runs twice a week all summer long at the scenic Del Crary Park, right on Little Lake. With acts ranging from Canadian rock legend Kim Mitchell to U2 tribute band Acrobat and the traditional Celtic sounds of The Mudmen, there’s something for every music lover. Bring your lawn chair, grab a snack from the food trucks, and enjoy a sunset performance in a truly unforgettable setting.

Canada Day Celebrations – Peterborough

📅 Dates: June 30 – July 1, 2025

📍 Locations: Quaker Foods City Square, City Hall, Millennium Park, and Del Crary Park

💵 Admission: Free

Canada Day in Peterborough is a two-day celebration packed with activities, music, and fireworks. The 2025 theme, “Roll, Stroll, and Celebrate,” promises fun for all ages, with accessible and inclusive programming across downtown and the waterfront. Highlights include a citizenship ceremony, multicultural food vendors, live performances, a family zone, and a spectacular fireworks display over the lake.

Lock & Paddle 2025

📅 Date: July 19, 2025

📍 Location: Peterborough Lift Lock

💵 Admission: Free

A truly one-of-a-kind event, Lock & Paddle invites hundreds of paddlers to float together in canoes and kayaks as they ascend the world’s highest hydraulic lift lock. Held in celebration of Canada’s Parks Day, this free community gathering is as much a visual spectacle as it is a celebration of history and togetherness. Whether you’re joining the paddle or watching from the sidelines, it’s a uniquely Peterborough experience you won’t want to miss.

Peterborough Folk Festival

📅 Dates: August 14–17, 2025

📍 Location: Nicholls Oval Park, Peterborough

💵 Admission: Free

This long-standing community event celebrates its 36th year in 2025. The Peterborough Folk Festival is one of Canada’s only remaining free, multi-day folk festivals. It showcases over 30 performers, including 12 local artists, and highlights a commitment to inclusivity, environmental sustainability, and family-friendly entertainment. With artisan vendors, a kids’ zone, workshops, and delicious local food, this festival is a must-attend for all ages.

Bobcaygeon Craft Beer and Food Festival

📅 Date: August 16, 2025

📍 Location: Kawartha Settlers’ Village, Bobcaygeon

💵 Admission: Ticketed

Set in the charming Kawartha Settlers’ Village, this festival combines great local brews with delicious food and small-town hospitality. Wander through historic buildings while sampling craft beer and cider from regional producers, enjoy live music, and soak in the rustic charm of one of the area’s most unique venues. It’s a relaxed, down-to-earth event with big flavour.

Kawartha Lakes Classic Cycling Tour

📅 Date: August 23, 2025

📍 Location: Kawartha Lakes

💵 Admission: Registration Required

More than just a ride, the Kawartha Lakes Classic is a celebration of active living and scenic beauty. With routes ranging from 18 km family rides to 160 km advanced routes, cyclists of all skill levels can enjoy a day of fresh air and countryside charm. Proceeds support local community services, making it a fun and meaningful way to get moving this summer.

Kawartha Arts Festival

📅 Dates: August 30–31, 2025

📍 Location: Fenelon Falls

💵 Admission: Free

Set in the heart of cottage country, the Kawartha Arts Festival is a celebration of visual art in all forms. Over 100 artists showcase their work—ranging from painting and sculpture to jewellery and photography. The festival also features live artist demos, a kids’ art showcase, and a chance to meet the creators behind the work. It’s a great way to support local talent and bring home a one-of-a-kind piece of art.

Plan Your Summer Adventure

Peterborough and the Kawarthas truly shine in summer, offering unforgettable experiences for music lovers, foodies, artists, families, and adventure-seekers alike. Mark your calendars, gather your friends, and make the most of these amazing events.

📍 Need more info or want to explore more events?

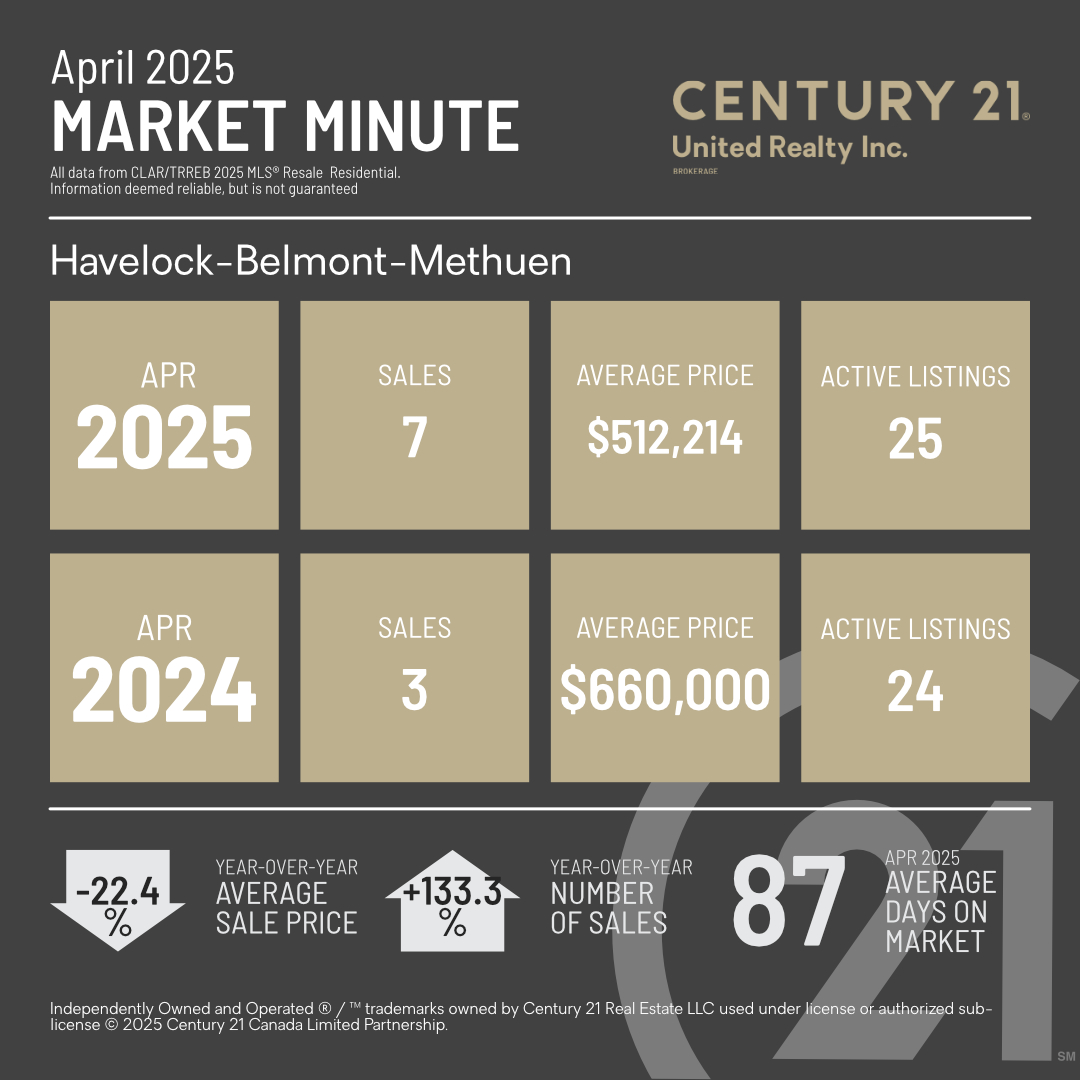

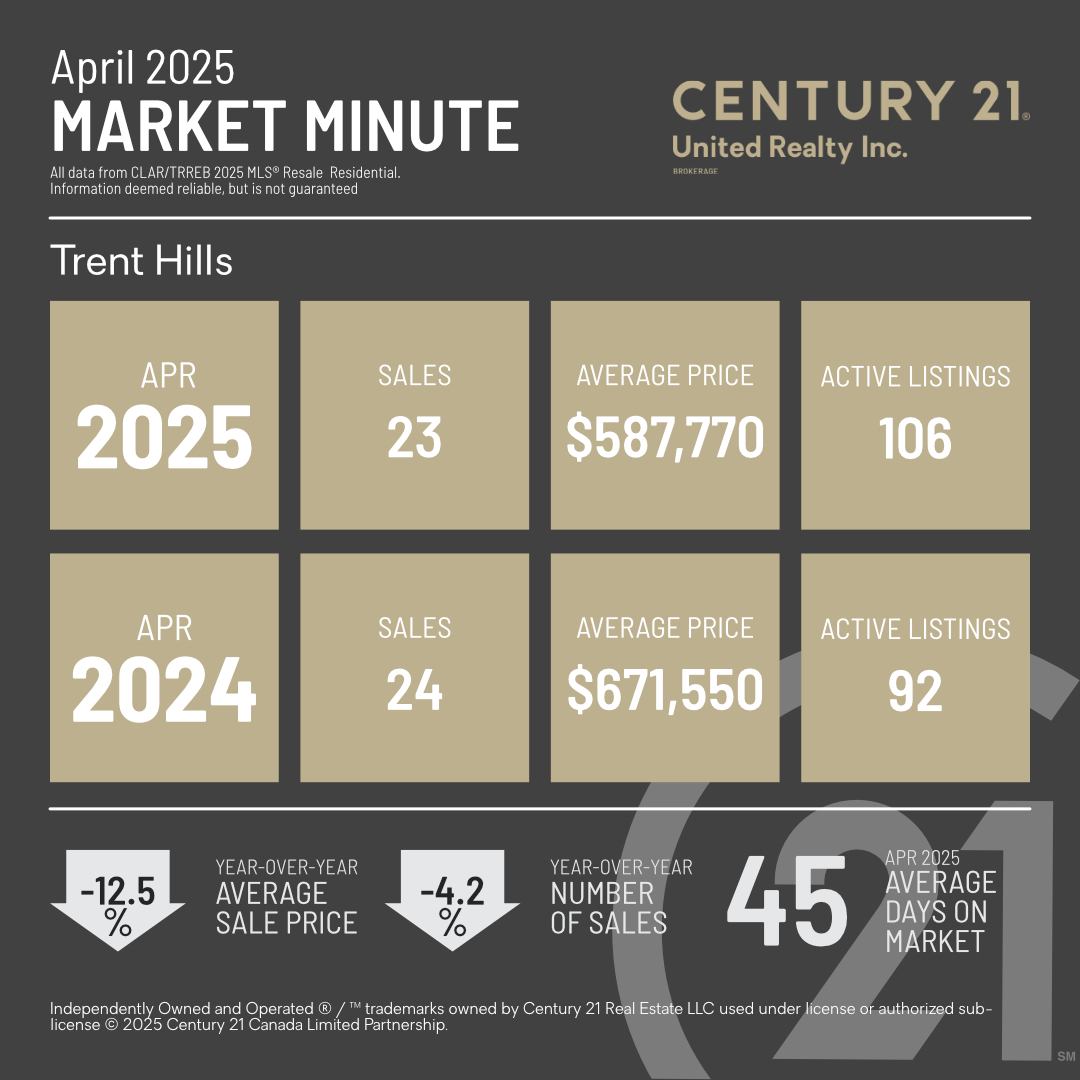

Real Estate Market Analysis for April 2025

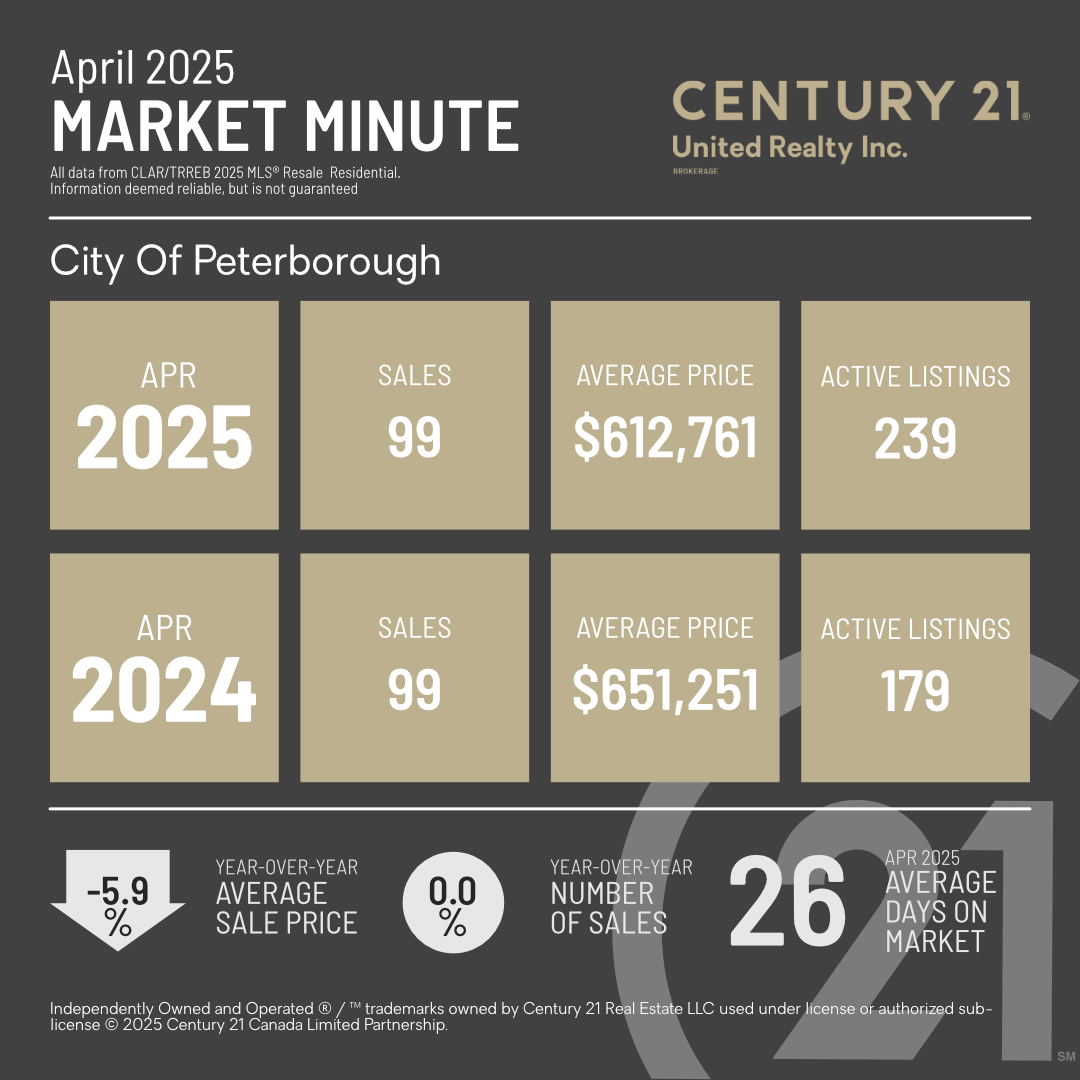

The April 2025 housing stats are in, and they tell the story of a balanced but evolving real estate market in the City of Peterborough. While sales activity remained steady compared to the same time last year, other indicators show that buyers are taking more time — and possibly enjoying a bit more choice — than they did a year ago.

Key Stats at a Glance:

| Stat | April 2025 | April 2024 | Year-Over-Year Change |

|---|---|---|---|

| Average Sale Price | $612,761 | $651,251 | -5.9% |

| Number of Sales | 99 | 99 | 0% |

| Active Listings | 239 | 179 | +33.5% |

Price Dip Creates Opportunities

The average sale price in April 2025 was $612,761 — a 5.9% decrease from April 2024. This drop may come as a surprise, especially given the flat number of sales year-over-year, but it reflects broader market adjustments as interest rates, inflation, and affordability continue to shape buyer behaviour. For buyers who were priced out of the market last spring, this could present a renewed opportunity to get into the market at a lower price point.

Inventory is Up — Giving Buyers More Choice

One of the most notable changes is the increase in active listings. With 239 homes on the market in April 2025, inventory is up more than 33% compared to the 179 listings in April 2024. This shift signals a more balanced market, where buyers aren’t feeling the same urgency or competition that defined earlier years.

More inventory generally translates to more negotiation power for buyers and, in many cases, less pressure to make snap decisions. Sellers, on the other hand, may need to ensure their pricing is competitive and that their homes are well-prepared for showings to stand out.

Homes Are Taking Longer to Sell

Homes took an average of 26 days to sell in April 2025 — a sign that the pace of the market has slowed slightly. This gives buyers a little more breathing room when making decisions, but it also underscores the importance of strategic marketing and realistic pricing for sellers.

What Does This Mean for You?

If you’re thinking of buying, now might be the time to explore your options. Prices have softened slightly, and there’s more inventory to choose from than we’ve seen in previous springs.

If you’re considering selling, success is still very possible — but it may require a bit more preparation and guidance. Pricing your home appropriately and working with an experienced real estate professional will help ensure your property attracts serious buyers.

Have questions about the Peterborough market or what these numbers mean for your plans?

We always have an agent on duty to help. Call our office at 705-743-4444 and we will be happy to direct you to a REALTOR® to answer your questions.

*All data from CLAR/TRREB 2025 & InfoSparks®© 2024 MLS® Resale Residential. Information deemed reliable but is not guaranteed.

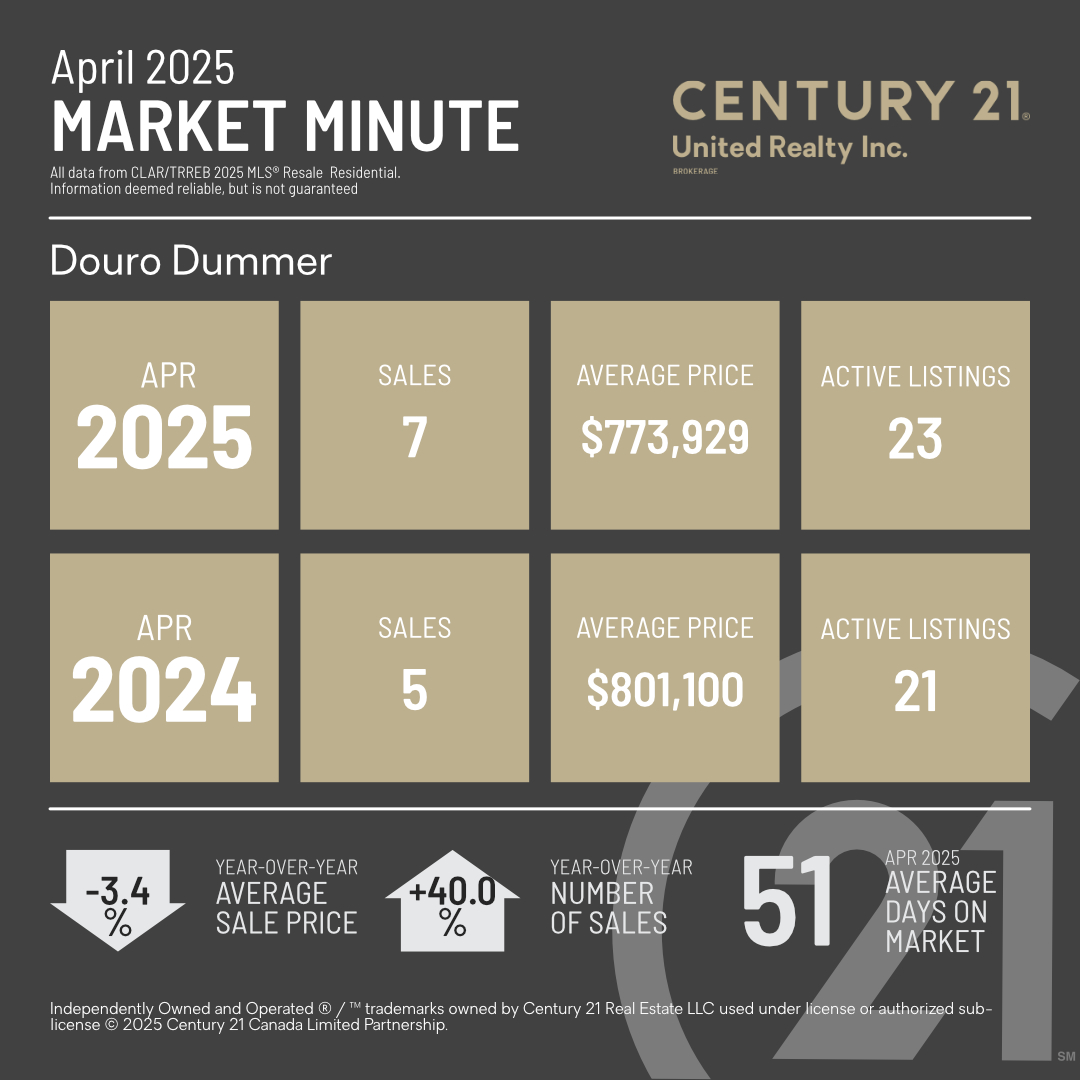

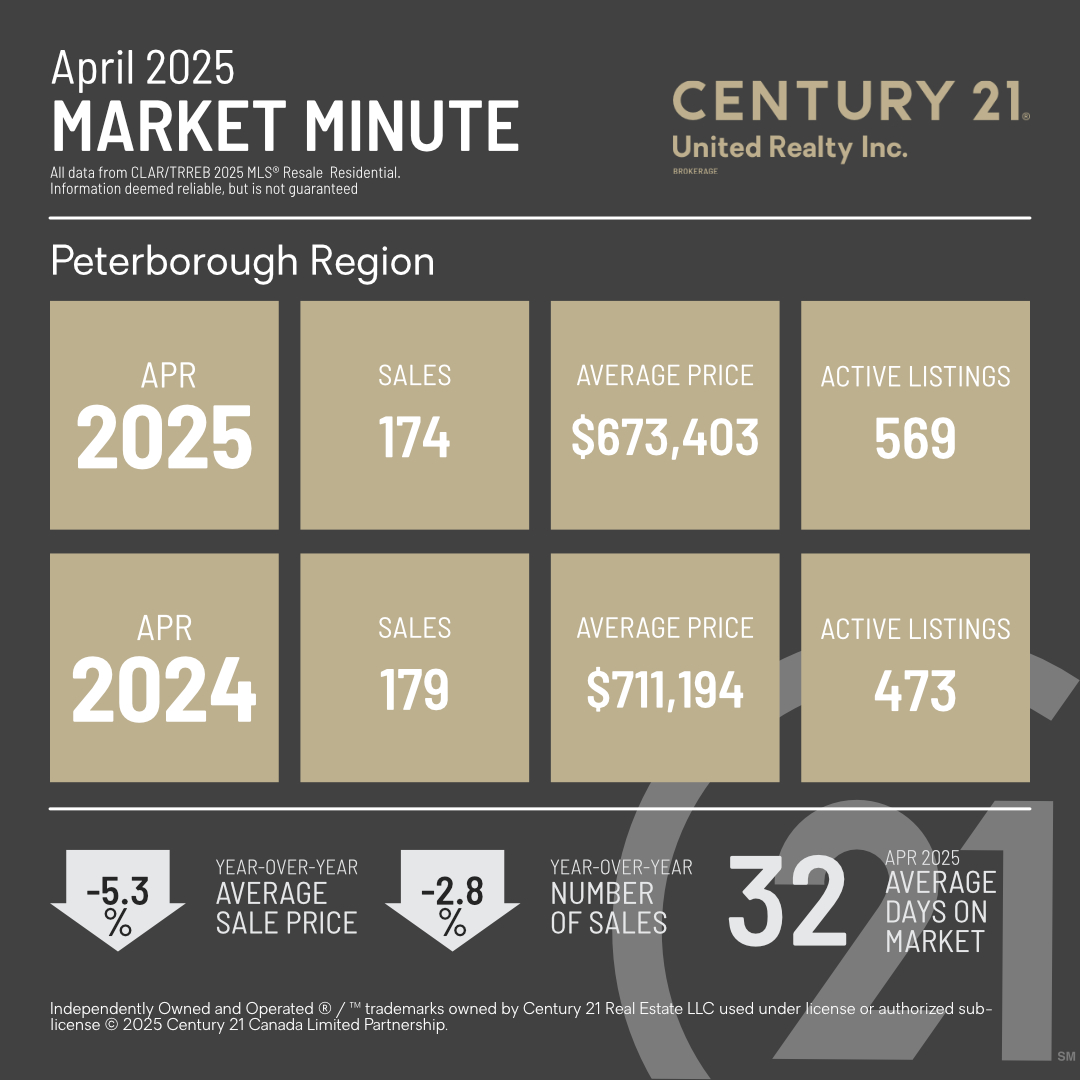

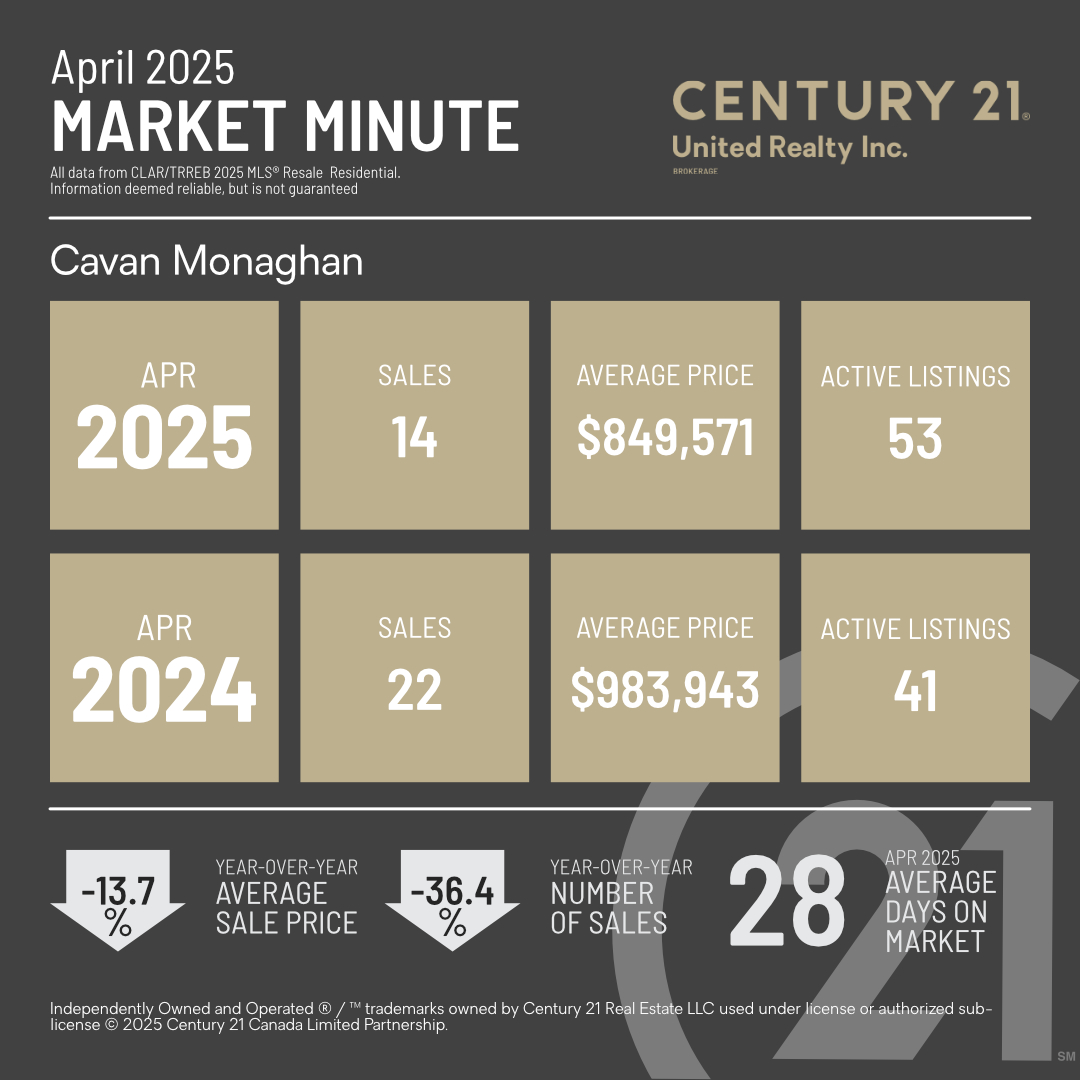

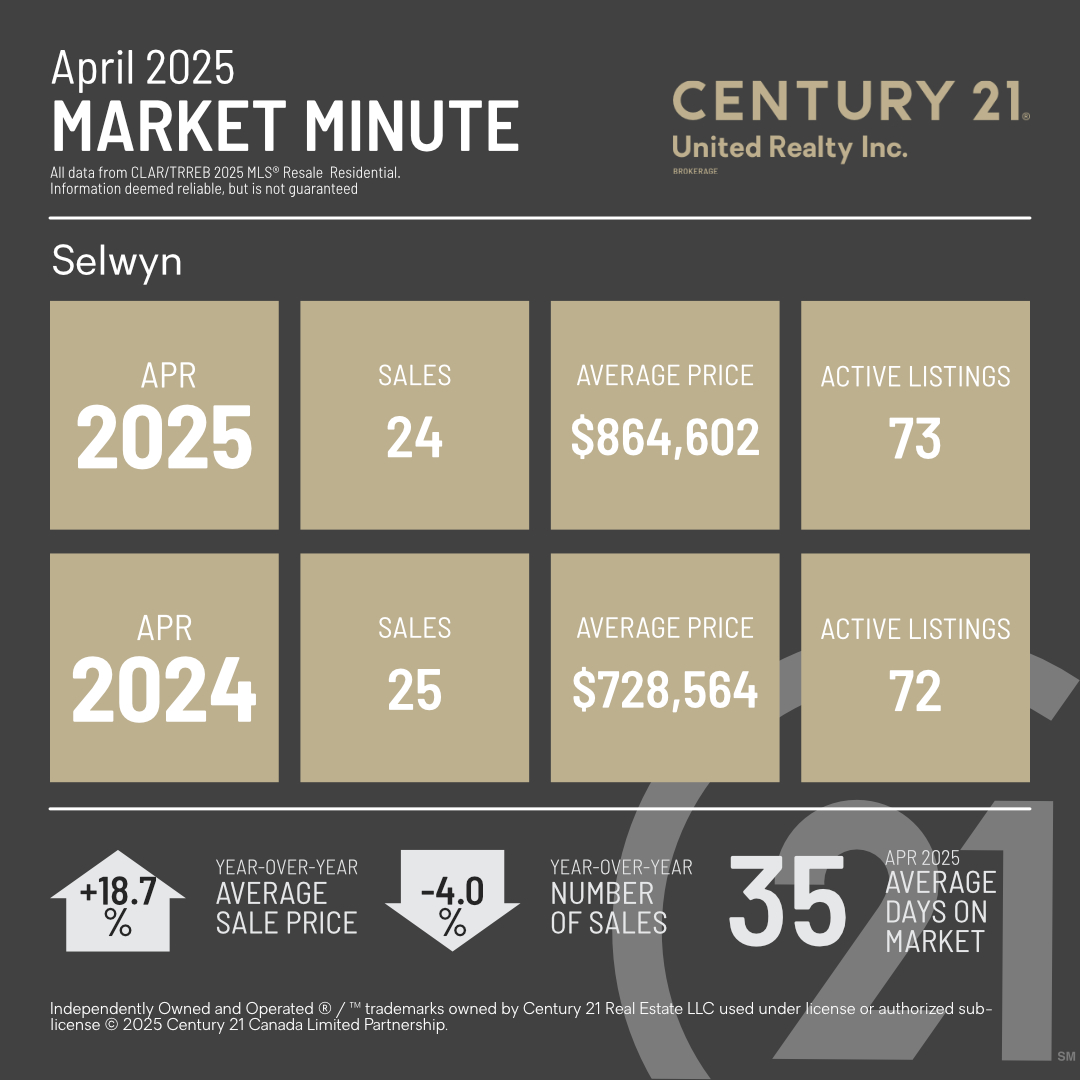

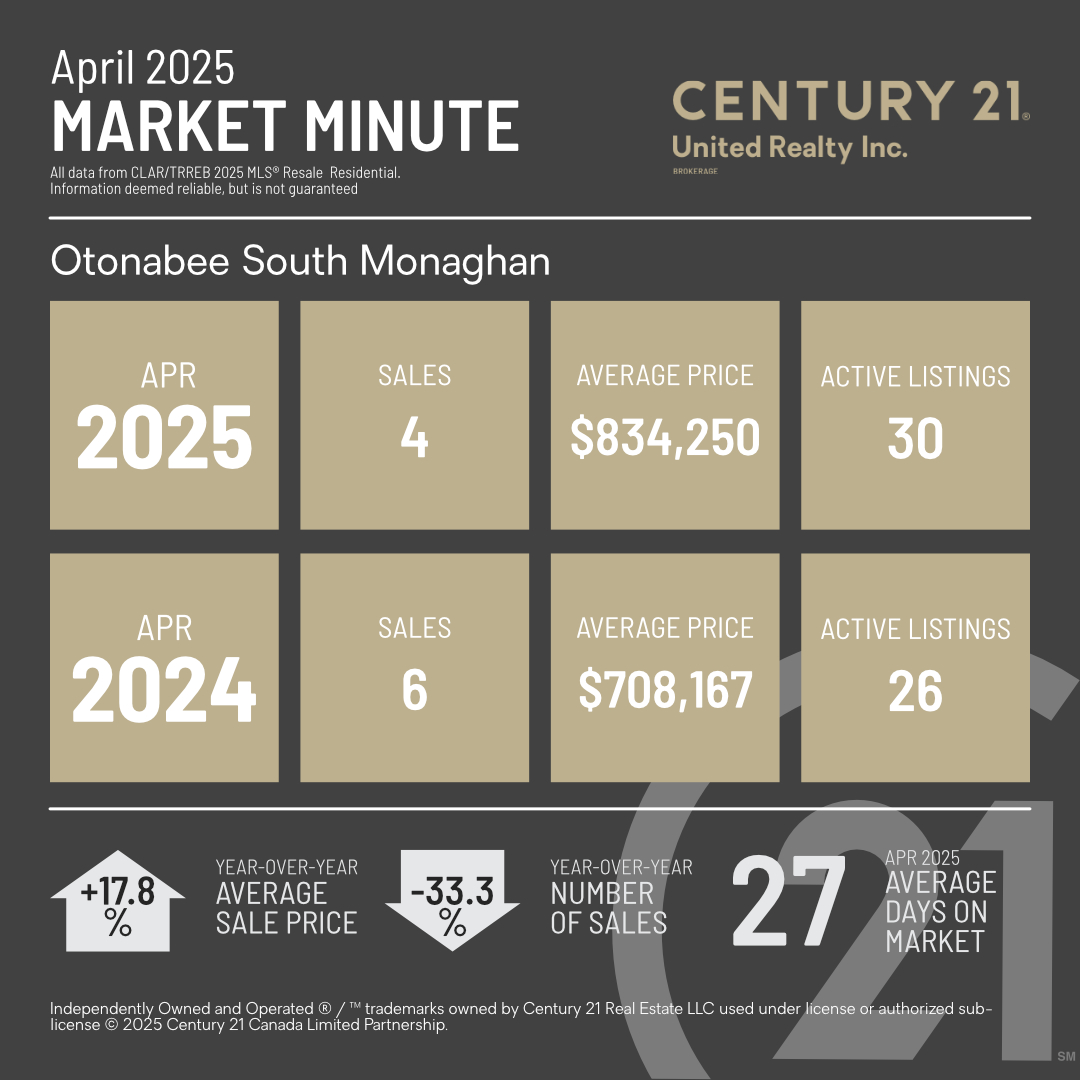

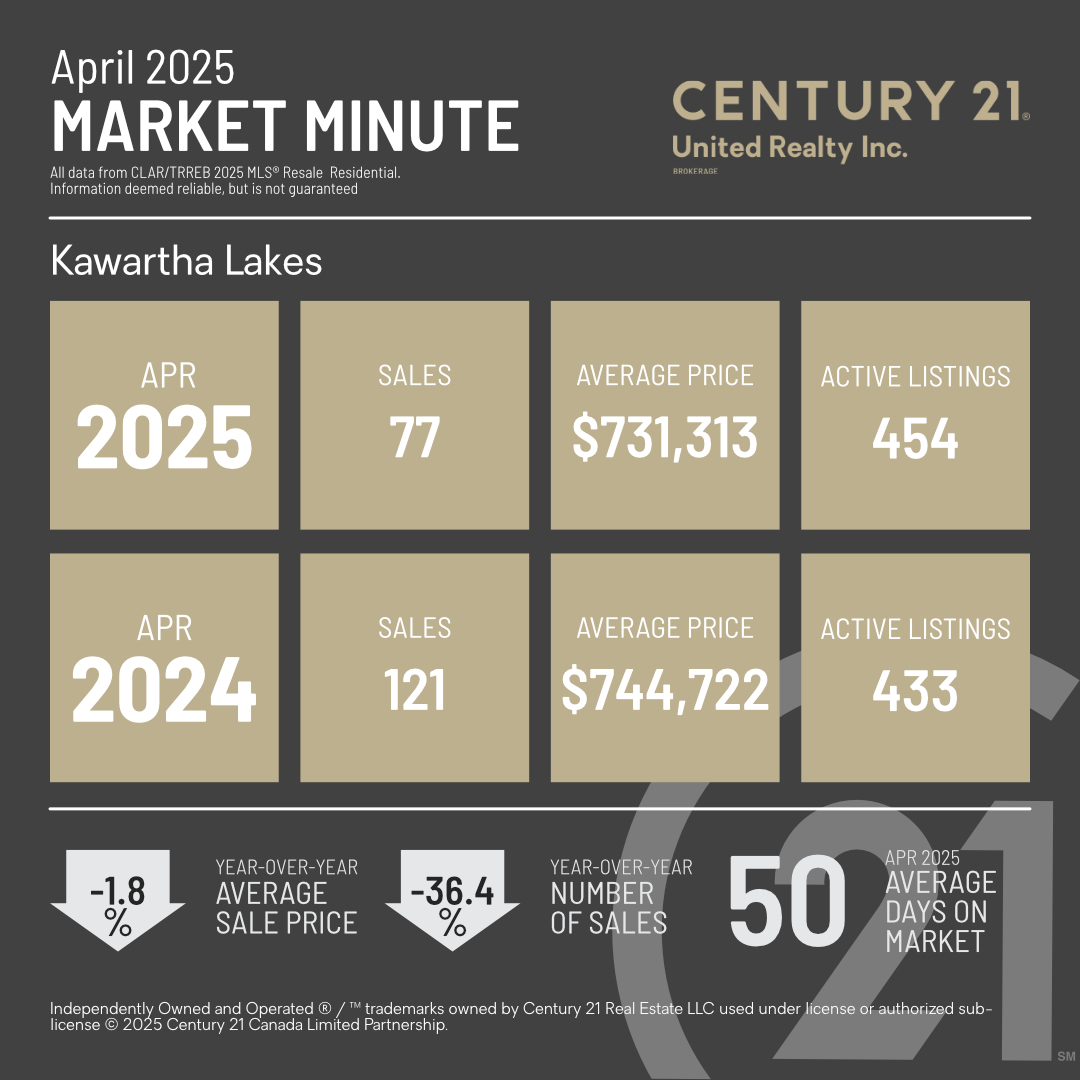

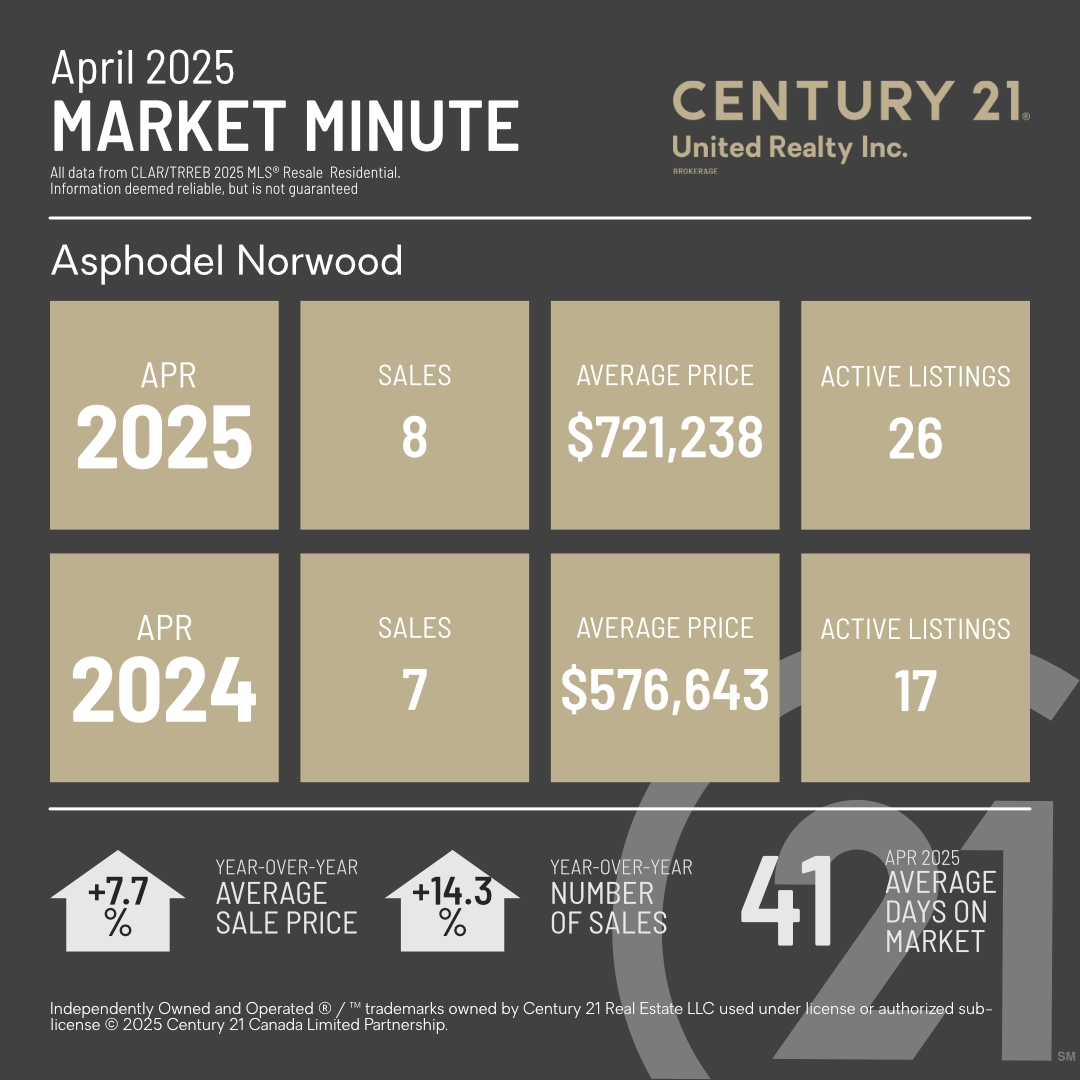

Highlighted below are some of the major areas we cover with our stats:

Preparing Your 3-Season Cottage for the Summer Season

As the last traces of winter melt away and spring gives way to warmer, sunnier days, it’s time to start thinking about opening up your 3-season cottage. Whether it’s tucked away in the Kawarthas, nestled beside a quiet lake, or perched in the woods, giving your cottage a proper seasonal opening sets the tone for a safe and relaxing summer.

Here’s a checklist to help you get your cottage summer-ready.

1. Do a Walk-Around Inspection

Before stepping inside, do a thorough walk-around of your property:

-

Check for damage to the roof, siding, foundation, or windows from snow, ice, or critters.

-

Look for fallen branches, leaning trees, or debris that may need to be cleared.

-

Inspect the deck and stairs for loose boards or nails.

2. Turn Utilities Back On Safely

If you had your utilities shut off for the winter, here’s what to do:

-

Hydro: Inspect your electrical panel before flipping breakers. Look for signs of rodent damage or corrosion.

-

Water system: Slowly turn your water back on and check all fixtures for leaks or cracks. If you use a well, test your water for safety.

-

Propane or gas: Reconnect tanks and test appliances carefully. Consider having a professional inspect connections and lines if it’s been a while.

3. Check for Pests

Mice, squirrels, and insects can take up residence over the winter:

-

Look for droppings, nests, or chew marks.

-

Open all cupboards and drawers.

-

Disinfect surfaces before use.

-

Set traps or call pest control if needed.

4. Air It Out

Let your cottage breathe after a long winter:

-

Open windows and doors to get air flowing.

-

Wash or replace musty curtains and linens.

-

Run a dehumidifier to help clear out dampness.

5. Test Smoke & CO Alarms

Safety first:

-

Check and replace batteries in smoke and carbon monoxide detectors.

-

Test each alarm to ensure it’s functioning properly.

-

Make sure you have a working fire extinguisher.

6. Inspect Watercraft & Docks

Getting out on the water is one of the best parts of cottage life:

-

Check your boat, canoe, or kayak for winter damage.

-

Reinstall the dock or ensure it’s securely fastened.

-

Check life jackets and safety equipment for wear.

7. Restock the Cottage

You’ll need to bring or replenish:

-

Non-perishable food and spices

-

Cleaning supplies and toiletries

-

Batteries, light bulbs, propane tanks

-

First aid kit and sunscreen

-

Fresh bedding and towels

8. Prep the Outdoor Living Spaces

Make it feel like summer:

-

Clean and set up patio furniture.

-

Prep the BBQ and refill propane.

-

Bring out summer gear like water toys, lawn games, and hammocks.

Final Tip: Make It a Tradition

Opening your cottage can feel like a chore, but with the right mindset (and maybe a cold drink waiting at the end), it’s also a chance to reconnect with your special summer place. Bring the family, delegate tasks, and make it a tradition you all look forward to.

Thinking of Buying or Selling a Cottage in the Kawarthas?

We specialize in waterfront and seasonal properties across the region. Reach out for expert advice, or download our free Waterfront Buying Guide to get started.

Spring Gardening Tips & Plant Picks for Peterborough, Ontario

As May approaches in Peterborough, Ontario, it’s the perfect time to prepare your garden for a vibrant growing season. With the last frost typically around May 18, now is ideal for planting perennials, sowing cool-weather vegetables, and refreshing your garden beds.

Top Plant Picks for Peterborough Gardens

Perennials & Flowers:

-

Black-Eyed Susan (Rudbeckia hirta): A native favourite, these bright yellow blooms attract pollinators and are drought-tolerant.

-

Purple Coneflower (Echinacea purpurea): Known for its resilience and pollinator appeal, it’s a staple in many local gardens.

-

Canada Mayflower (Maianthemum canadense): A shade-loving groundcover with delicate white flowers, perfect for woodland areas.

-

Willowleaf Aster (Symphyotrichum praealtum): This late-summer bloomer supports pollinators and adds colour to your garden.

Vegetables:

-

Carrots (Tenderlong Imperator): Ideal for direct sowing in early May; they thrive in Peterborough’s soil.

-

Tomatoes (Beefsteak Bush): Start seeds indoors now for transplanting after the last frost.

Gardening Tips for May

-

Mulching: Apply mulch carefully, keeping it away from plant stems to prevent rot and pests.

-

Planting Time: Avoid planting during heat waves. Opt for cooler mornings or evenings to reduce plant stress.

-

Watering: Water deeply but less frequently to encourage strong root growth.

-

No Mow May: Consider participating to support pollinators by letting your lawn grow naturally for the month.

Happy gardening! May your Peterborough garden flourish with colour and life this season.

Seasonal Roof Inspections: Why They Matter More Than You Think

When it comes to maintaining your home, your roof often falls into the “out of sight, out of mind” category. But just like your car needs regular oil changes, your roof needs seasonal check-ups to stay in peak condition—especially in a place like Peterborough, where we experience all four seasons in full force.

Here’s why scheduling regular roof inspections is a smart move for homeowners:

1. Catch Small Problems Before They Grow

Tiny issues like cracked shingles, minor leaks, or clogged gutters can escalate into costly repairs if left unchecked. A seasonal inspection—especially after winter storms or heavy rain—can identify these problems early and save you a ton of money down the line.

2. Prepare for Winter and Spring Weather

In the fall, a roof inspection ensures your home is ready for the snow, ice, and freeze-thaw cycles that can wreak havoc on roofing materials. In the spring, it’s all about checking for damage caused by ice dams, high winds, or water intrusion. Each season brings its own set of challenges, so staying ahead of the weather is key.

3. Protect Your Home’s Value

Your roof plays a huge role in your home’s curb appeal and overall value. A neglected roof can raise red flags for future buyers, while a well-maintained one gives peace of mind and boosts your home’s resale potential. Think of it as a long-term investment in your property.

4. Extend the Life of Your Roof

Regular inspections and minor maintenance can add years to the life of your roof. Replacing a roof is a major expense—inspections help ensure you get the most out of your current one before needing to make that leap.

What Does a Roof Inspection Include?

A qualified roofing professional will typically check:

-

Shingles or roofing materials for wear, cracks, or damage

-

Flashing around vents, chimneys, and skylights

-

Gutter and downspout condition

-

Signs of mould, rot, or interior leaks

-

Proper attic ventilation and insulation

When to Schedule Roof Inspections

We recommend having your roof inspected twice a year: once in the spring, and once in the fall. And always after a major weather event like a windstorm or heavy snowfall.

The Bottom Line: Seasonal roof inspections are a small effort that can prevent big problems. Whether you’re planning to sell, just bought a home, or have lived in your place for years, keeping your roof in good shape protects one of your most important investments—your home.

Thinking of selling? A recent roof inspection can be a great selling point to include in your listing details!

Exploring the Best Walking Trails in Peterborough, Ontario and Surrounding Areas

Nestled in the heart of the Kawarthas, Peterborough, Ontario, offers a plethora of scenic walking trails that cater to nature enthusiasts, casual strollers, and avid hikers alike. Whether you’re seeking tranquil riverside paths, dense forest routes, or expansive conservation areas, Peterborough and its surroundings have something to offer. Here’s a curated list of some of the top walking trails in the region:

Top Walking Trails in Peterborough

1. Jackson Creek Kiwanis Trail

This 10-kilometre stretch of the Trans Canada Trail connects Jackson Park in Peterborough to the towns of Hastings and Lindsay. The multi-use path travels along the Otonabee River through Millennium Park, offering scenic views and a peaceful walking experience. Wikipedia

2. Rotary Greenway Trail

A 25-kilometre multi-use trail that begins at Little Lake and continues past Trent University to the village of Lakefield in Selwyn Township. The trail features benches and informative signage about the area’s history, environment, and ecology. Wikipedia

3. Mark S. Burnham Trail

Located within the Mark S. Burnham Provincial Park, this trail offers a serene walking experience amidst mature forests. It’s a popular spot for those seeking a quiet nature walk close to the city. AllTrails.com

Notable Trails in the Surrounding Areas

4. Robert Johnston EcoForest Trails

Situated in the township of Douro-Dummer, approximately 15 km east of Peterborough, this area boasts four well-marked trails totalling nearly 5.5 km. Walkers can enjoy a mix of pine forests and deciduous shrubs, with opportunities to spot local wildlife. 1000 Places and Memories

5. Mathison Conservation Area

Located north of Havelock, this 250-acre area features 1.6 km of multi-use trails suitable for walking, biking, and snowmobiling, as well as 1.1 km of walking-only trails. The scenic forests and wetlands provide a tranquil setting for nature walks. The Kawarthas Tourism

6. Millbrook Valley Trails

These trails offer a variety of walking paths through forests and along streams in the Millbrook area. It’s a favourite among locals for its natural beauty and well-maintained paths.

Dog-Friendly Trails

Many of the trails in and around Peterborough are dog-friendly, provided pets are kept on a leash. Notable options include the Trent Wildlife Sanctuary: Blue Trail, Mark S. Burnham Trail, and the Jackson Creek Kiwanis Trail.

Trail Maps and Additional Resources

-

City of Peterborough Trails: The city’s official website offers detailed information on local trails, including maps and guidelines. City of Peterborough Home Page

-

AllTrails – Peterborough: A comprehensive resource for trail reviews, photos, and user experiences in the Peterborough area. AllTrails.com

-

The Kawarthas Parks & Trails: Explore more about the parks and trails in the Kawarthas region. The Kawarthas Tourism

Whether you’re a local resident or a visitor, the walking trails in Peterborough and its surrounding areas offer a delightful way to experience the natural beauty of Ontario. So lace up your walking shoes, grab a map, and embark on an adventure through these scenic paths!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link