Easter Weekend Events in Peterborough & The Kawarthas

Easter weekend is just around the corner, and Peterborough and the Kawarthas are full of festive fun for the whole family. Whether you’re hunting for chocolate eggs, enjoying a cozy brunch, or getting out for a spring stroll, there’s something for everyone to enjoy.

🐣 Family-Friendly Easter Egg Hunts

1. New Life Church Annual Easter Egg Hunt

-

Date: Saturday, April 19, 2025

-

Time: 1:00 PM – 3:00 PM

-

Location: New Life Church, 4014 Wallace Point Rd., Peterborough

-

Details: This beloved free community event features an Easter egg hunt, cotton candy, a bouncy castle, crafts, and face painting. Bring your own basket and join in the fun!

2. The Kawarthas Tourism Easter Egg Hunt

-

Date: Saturday, April 19, 2025

-

Location: Across the Kawarthas (details TBA on thekawarthas.ca)

-

Details: Search for colourful eggs hidden at select local attractions and businesses! This self-guided hunt encourages families to explore the region while collecting Easter treats and clues along the way.

🍽️ Easter Brunches & Treats

3. Easter Brunch at Chemong Lodge

-

Date: Sunday, April 20, 2025

-

Time: 9:00 AM – 2:00 PM

-

Location: Chemong Lodge, 764 Hunter St. Bridgenorth

-

Details: Enjoy a cozy and delicious brunch featuring locally inspired fare, Easter-themed desserts, and a scenic view of Chemong Lake. Reservations recommended.

4. Easter Brunch at The Riverside Grill + Lounge

-

Date: Sunday, April 20, 2025

-

Time: 11:00 AM – 2:00 PM

-

Location: Riverside Grill, 150 George Street North, Peterborough

-

Details: Indulge in a gourmet brunch featuring a full hot and cold buffet. Reservations recommended.

5. Sweet Treats at Kawartha Cupcake Co.

-

Date: April 18–20, 2025

-

Location: Downtown Lindsay

-

Details: Don’t miss out on limited-edition Easter cupcakes and pastries—perfect for gifting or treating yourself this holiday weekend.

🐰 Unique Local Experiences

6. Easter Window Display Scavenger Hunt

-

Date: Saturday, April 19, 2025

-

Time: 10:00 AM – 3:00 PM

-

Location: Downtown Lindsay

-

Details: Take a stroll through downtown Lindsay and participate in a festive scavenger hunt featuring decorated Easter windows. Fun for kids and adults alike!

7. Spring Nature Walk at Trent Hills

- Location: Trent Hills Conservation Area

-

Details: Welcome spring with a nature walk through scenic trails. A great way to stretch your legs and spot early signs of the season.

No matter how you choose to celebrate, Easter weekend in Peterborough and the Kawarthas offers a beautiful mix of fun, food, and fresh air. Happy Easter! 🌷🐣

Spring on a Budget: Outdoor Décor Ideas That Won’t Break the Bank

Spring is here—and with it comes sunshine, longer days, and the irresistible urge to spend more time outside. Whether you have a sprawling backyard, a cozy patio, or just a small balcony, now is the perfect time to spruce up your outdoor space. The good news? You don’t need to spend a fortune to create a fresh, inviting vibe.

Here are some budget-friendly outdoor décor ideas to help you welcome spring in style:

1. Add Pops of Colour with Planters

Nothing says “spring” like flowers in bloom. Head to your local garden centre or even a dollar store to pick up affordable pots and planters. Get creative with bright colours, or DIY your own painted terracotta pots for a custom touch. Fill them with hardy, inexpensive blooms like pansies, marigolds, or petunias.

Pro Tip: Upcycle items like tin cans, old mugs, or wooden crates into quirky planters for a charming rustic look.

2. String Up Some Magic

Outdoor string lights instantly elevate any space. Drape them along a fence, wrap them around your railing, or hang them overhead for a cozy glow. Solar-powered options are both energy-efficient and wallet-friendly, and you’ll skip the hassle of extension cords.

3. DIY Outdoor Pillows

Refresh your patio furniture with cheerful throw pillows. Instead of buying new ones, grab some inexpensive fabric or use old tablecloths to sew your own pillow covers. Look for bold patterns and vibrant colours to echo the season.

No-sew hack: Use fabric glue and iron-on tape to create pillow covers if sewing isn’t your thing.

4. Create a Container Garden

Don’t have room for a garden bed? No problem! Container gardens are perfect for small spaces. Mix herbs, flowers, and even vegetables in planters for a lush, layered look. Bonus: you’ll have fresh herbs like basil and mint right outside your door.

5. Thrift & Repurpose

Before heading to a big-box store, browse local thrift shops or Facebook Marketplace. You’d be surprised how often you can find outdoor furniture, plant stands, and décor pieces at a fraction of the price. A coat of spray paint can breathe new life into old metal or wicker items.

6. Lay Down an Outdoor Rug

Outdoor rugs help define your space and add comfort underfoot. Look for budget-friendly options at home discount stores, or try an indoor rug with weather-resistant materials. You can even stencil your own pattern onto a plain rug for a personal touch.

7. Welcome Spring with a Wreath

Your front door deserves a little spring cheer, too! Make your own seasonal wreath with faux florals, a wire frame, and a bit of hot glue. It’s a quick and easy way to boost curb appeal for just a few dollars.

You don’t need a huge budget to create a beautiful, welcoming outdoor space this spring. With a little creativity and a few DIY touches, you can enjoy your porch, patio, or balcony all season long.

So grab your sunglasses, put on some music, and let’s make the most of spring—right in your own backyard.

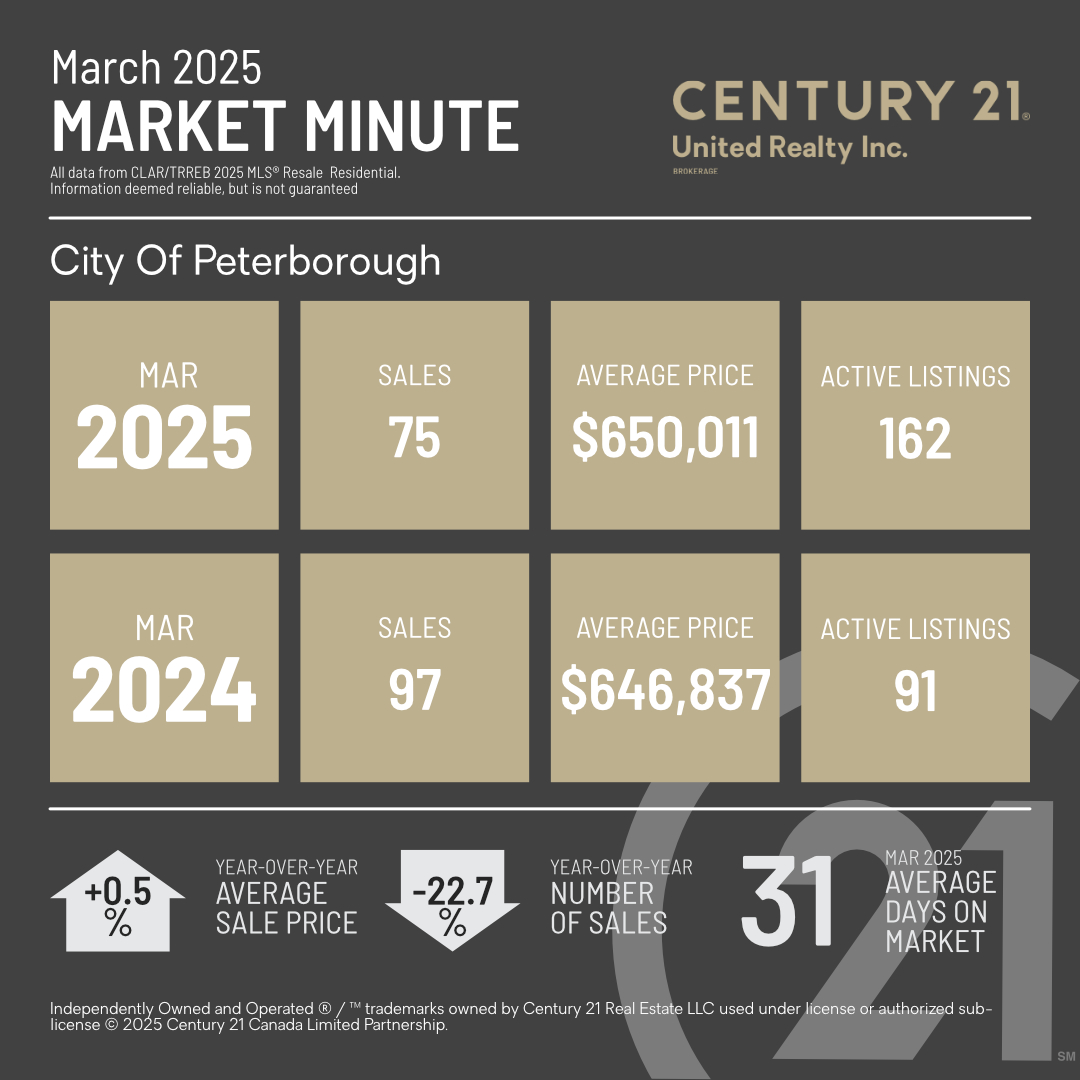

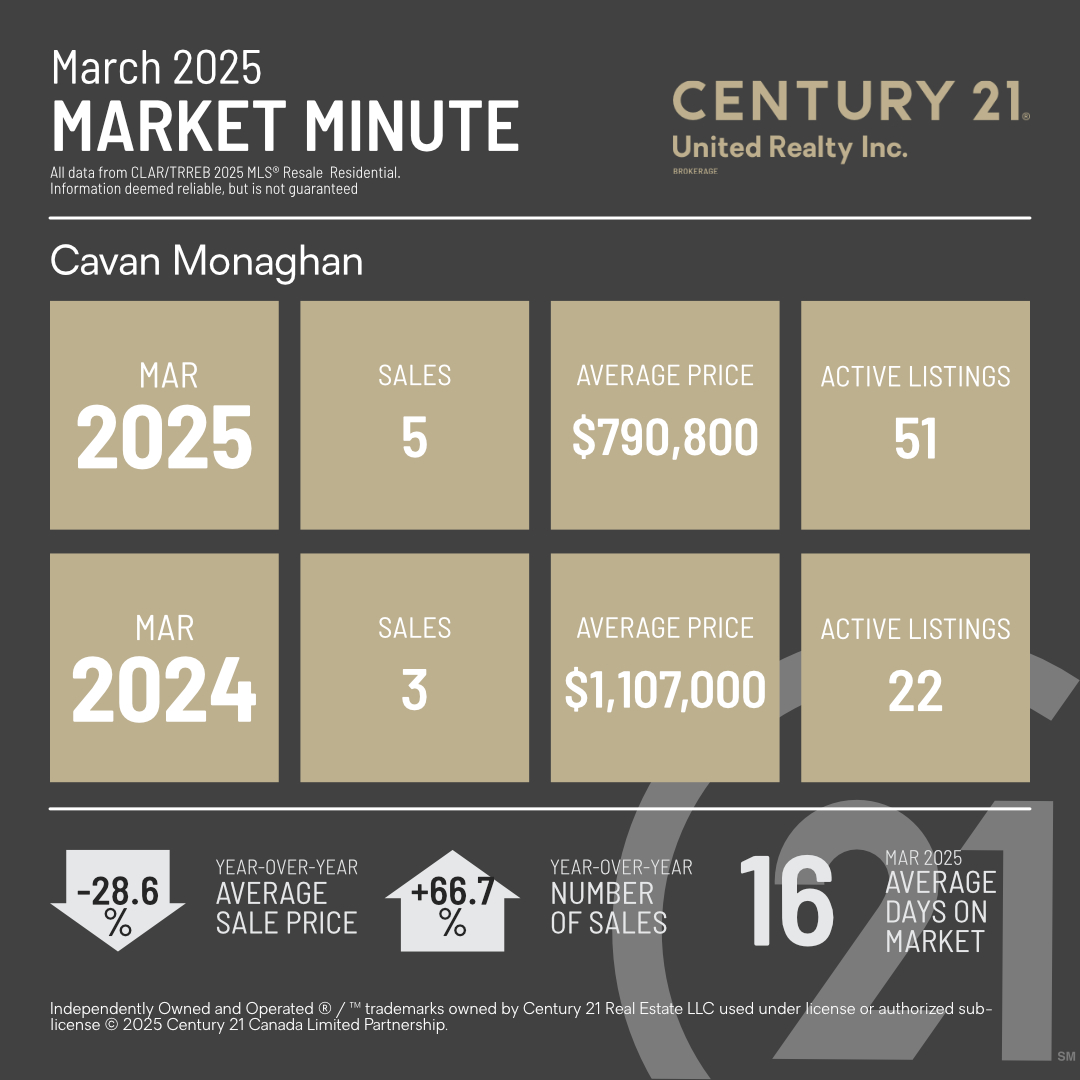

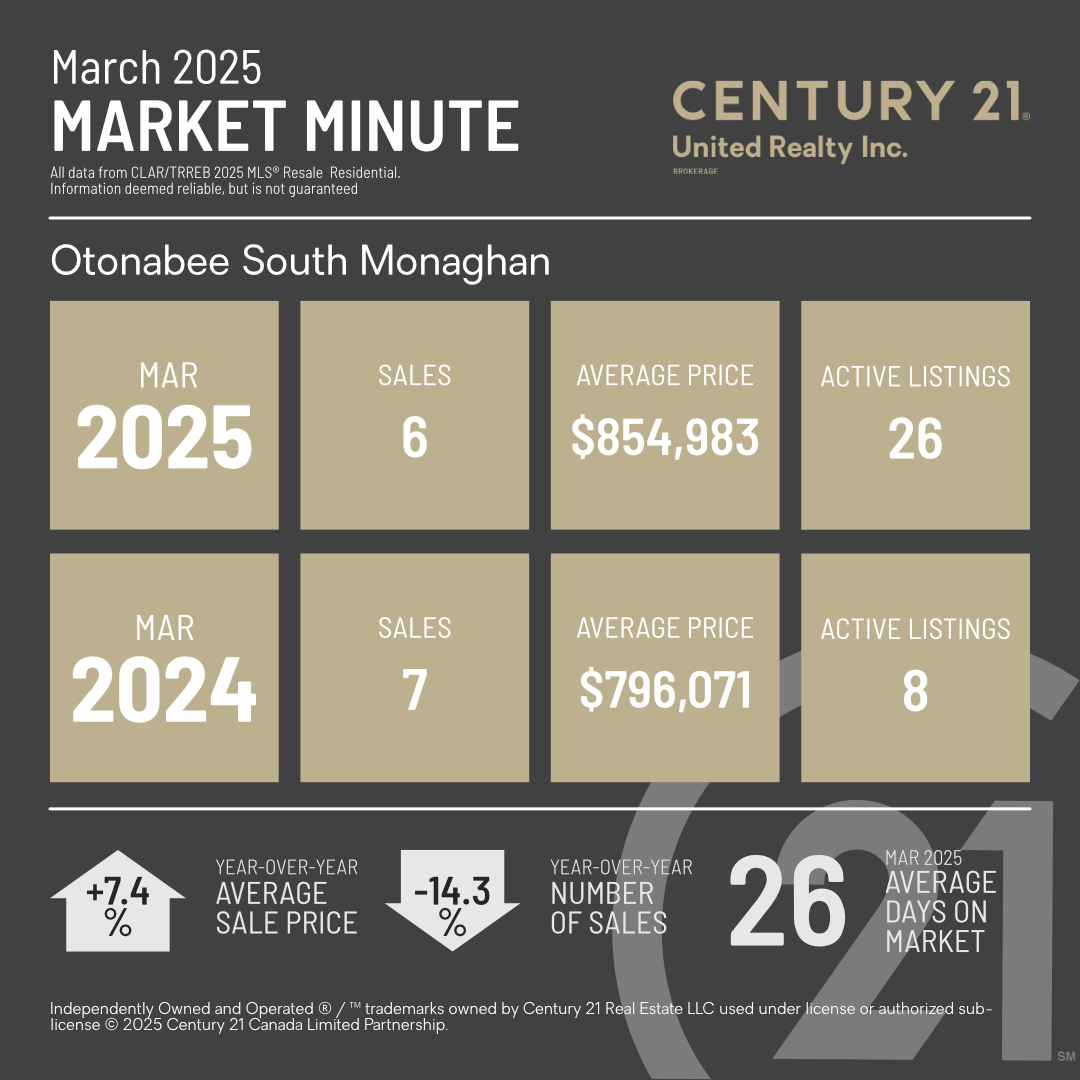

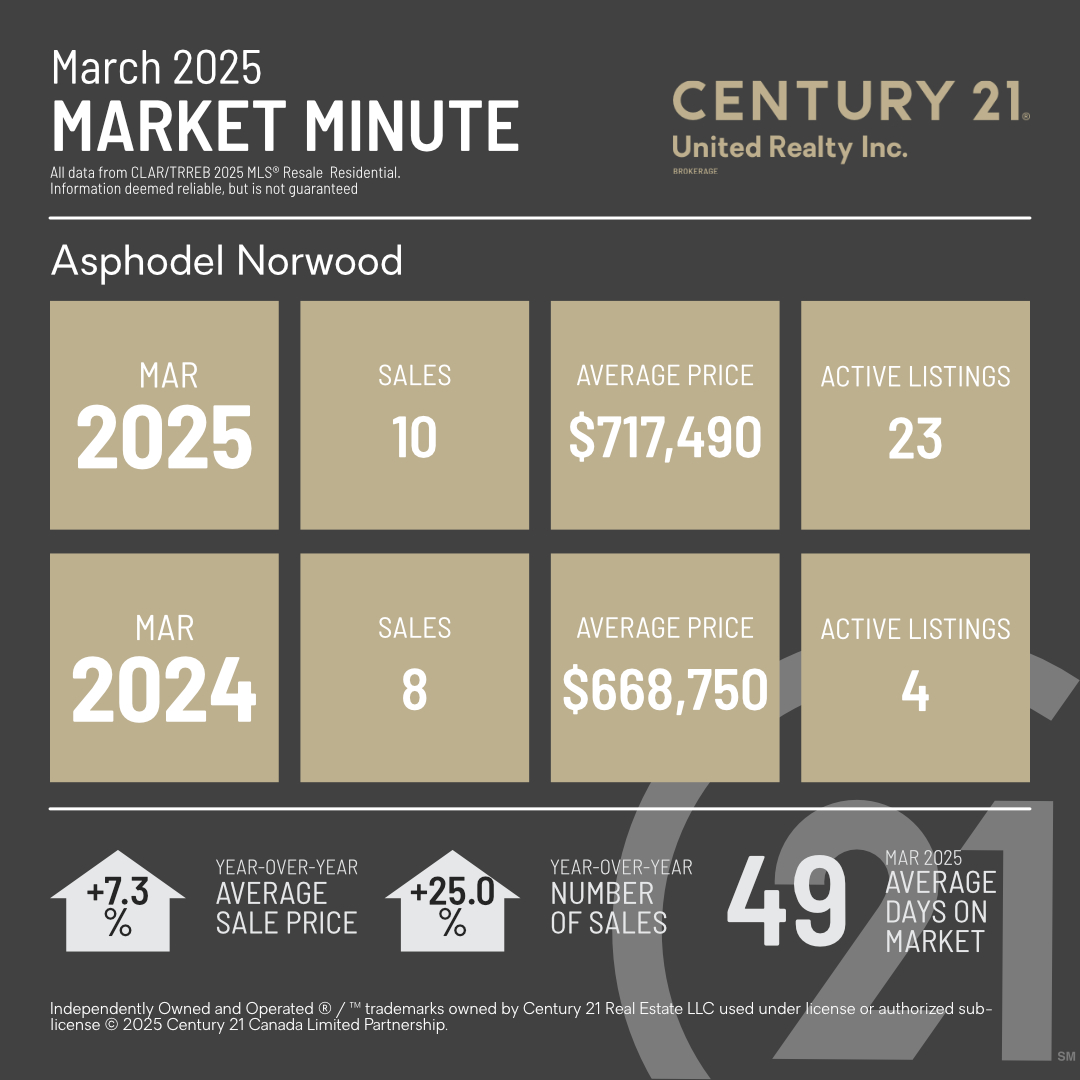

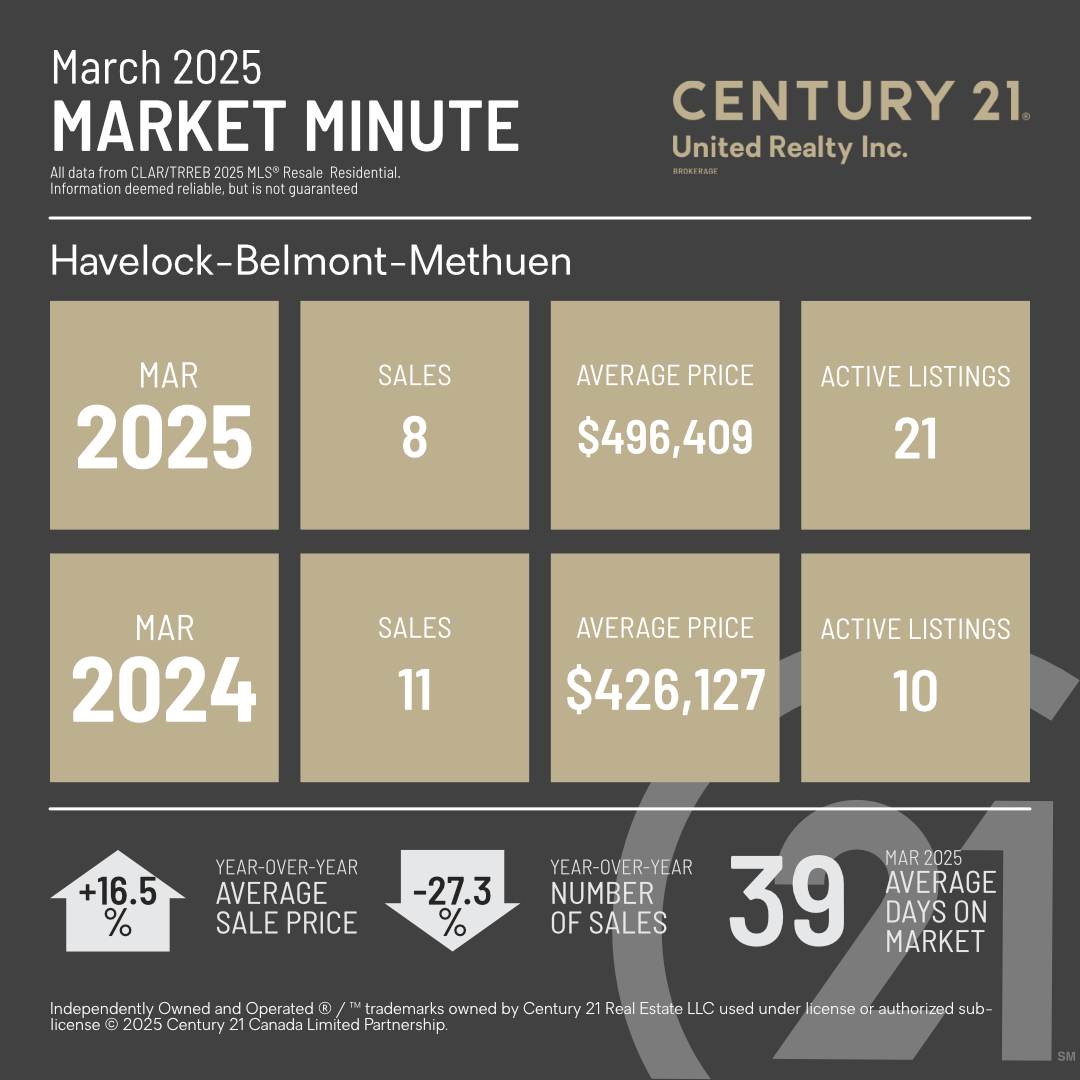

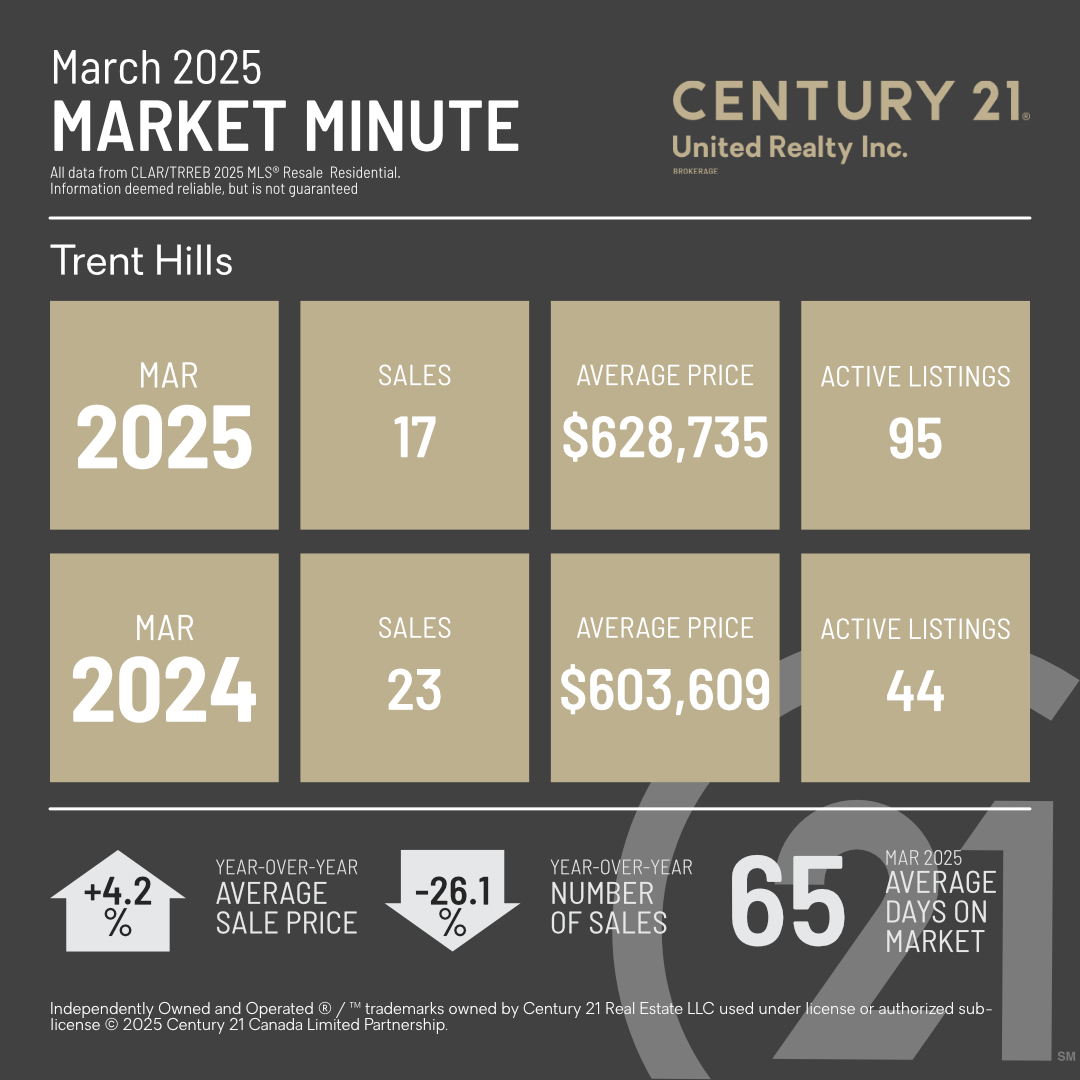

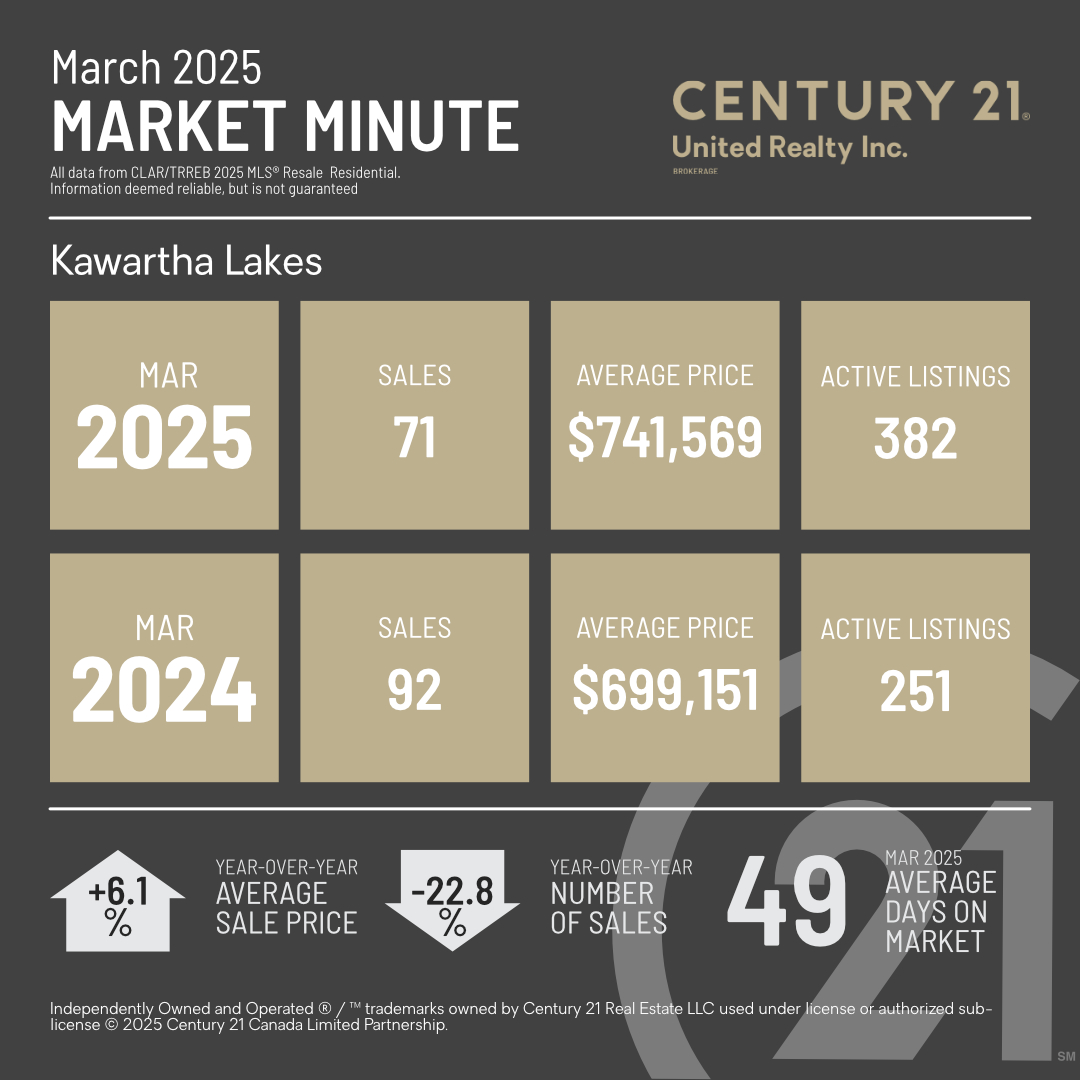

Real Estate Market Analysis for March 2025

Spring is typically one of the busiest seasons in real estate, but this March, Peterborough’s housing market is telling a slightly different story. While prices remain relatively stable, the pace of sales has slowed, and inventory levels are climbing. Whether you’re thinking about buying, selling, or just keeping an eye on the local market, here’s what the latest data means for you.

📉 Sales Volume Takes a Hit

The average number of home sales in March 2025 dropped to 75, down significantly from 97 sales in March 2024—a 22.7% decline year over year. This is one of the more notable trends in this month’s report.

Several factors may be contributing to this cooldown in activity:

-

Interest rates, while more stable than last year, are still relatively high, and some buyers may be waiting on the sidelines in hopes of future cuts.

-

Affordability continues to be a challenge, especially for first-time buyers.

-

Some buyers and sellers may simply be waiting for the usual spring rush to pick up before making a move.

While this slowdown may seem concerning, it’s important to remember that the market is still adjusting after several years of extreme fluctuations. What we’re seeing now could simply be a return to more balanced, sustainable conditions.

🌐 Broader Economic Uncertainty is a Key Factor

One of the biggest influences on the current market isn’t just interest rates or inventory levels—it’s growing economic unease at the national and international level.

Canada is currently bracing for a period of economic uncertainty. The U.S. has recently imposed a new round of tariffs on Canadian goods, which is expected to impact several key industries and could trickle down to consumer confidence. These trade tensions come at a time when economists are warning of a possible recession on the horizon. With inflation still stubborn and the Bank of Canada taking a cautious approach to rate cuts, many Canadians are treading carefully when it comes to major financial decisions—including real estate.

This uncertainty can help explain why even as inventory grows and prices hold steady, buyers are hesitant to jump into the market. They’re watching rates, waiting on economic news, and looking for stability before making their move.

💰 Home Prices Holding Steady

Despite the lower number of sales, home prices in Peterborough have remained stable. The average sale price in March 2025 was $650,011, a slight increase of 0.5% over the March 2024 average of $646,837.

This small year-over-year uptick in price, despite fewer transactions, suggests that sellers are holding firm on their pricing and that demand—while quieter—is still present. For sellers, this is a reassuring sign that property values remain strong, particularly for well-maintained homes in desirable neighbourhoods.

🏡 Inventory on the Rise

One of the most significant changes this March is the increase in active listings. In 2025, there were 162 homes listed for sale, compared to just 91 listings in March 2024. That’s a 78% increase in inventory.

This means buyers have more choice and less competition—welcome news after years of bidding wars and tight supply. However, it also means sellers need to be more strategic. With more properties on the market, buyers are being selective. Homes that are priced too high or not presented well may sit longer or receive fewer offers.

⏳ Days on Market: Still Reasonable

Despite all this, homes in Peterborough are still selling at a healthy pace. The average number of days on market was 31 in March 2025. That’s relatively brisk, especially when compared to more sluggish markets in other parts of Ontario.

This tells us that buyers are out there—they’re just being a little more cautious and taking their time to make the right decision.

What This Means for Buyers and Sellers

🛍️ Buyers:

You’re in a better position than you were a year ago. More listings mean more options, and stable prices allow for more predictable budgeting. If you’ve been waiting for the right time to jump into the market, this could be your moment, especially before any anticipated rate drops later this year, which could reignite competition.

💼 Sellers:

You can still achieve strong sale prices, but presentation and pricing are more important than ever. Work with a real estate professional to make sure your home is positioned properly in today’s more competitive landscape. It’s no longer enough to just list and wait—strategic marketing matters.

The Peterborough real estate market in March 2025 is reflective of a nationwide mood of caution. Sales are down, but prices are holding steady. Inventory is up, offering buyers more breathing room. And in the background, economic uncertainty—from global trade tensions to domestic recession worries—is creating hesitation.

If you’re thinking about buying or selling, reach out to discuss how these market changes may impact your plans. Staying informed is the best way to make confident real estate decisions! Looking for a reliable and knowledgeable REALTOR®? We always have an agent on duty to help. Call our office at 705-743-4444 and we will be happy to direct you to a REALTOR® to answer your questions.

*All data from CLAR/TRREB 2024 & InfoSparks®© 2023 MLS® Resale Residential. Information deemed reliable but is not guaranteed.

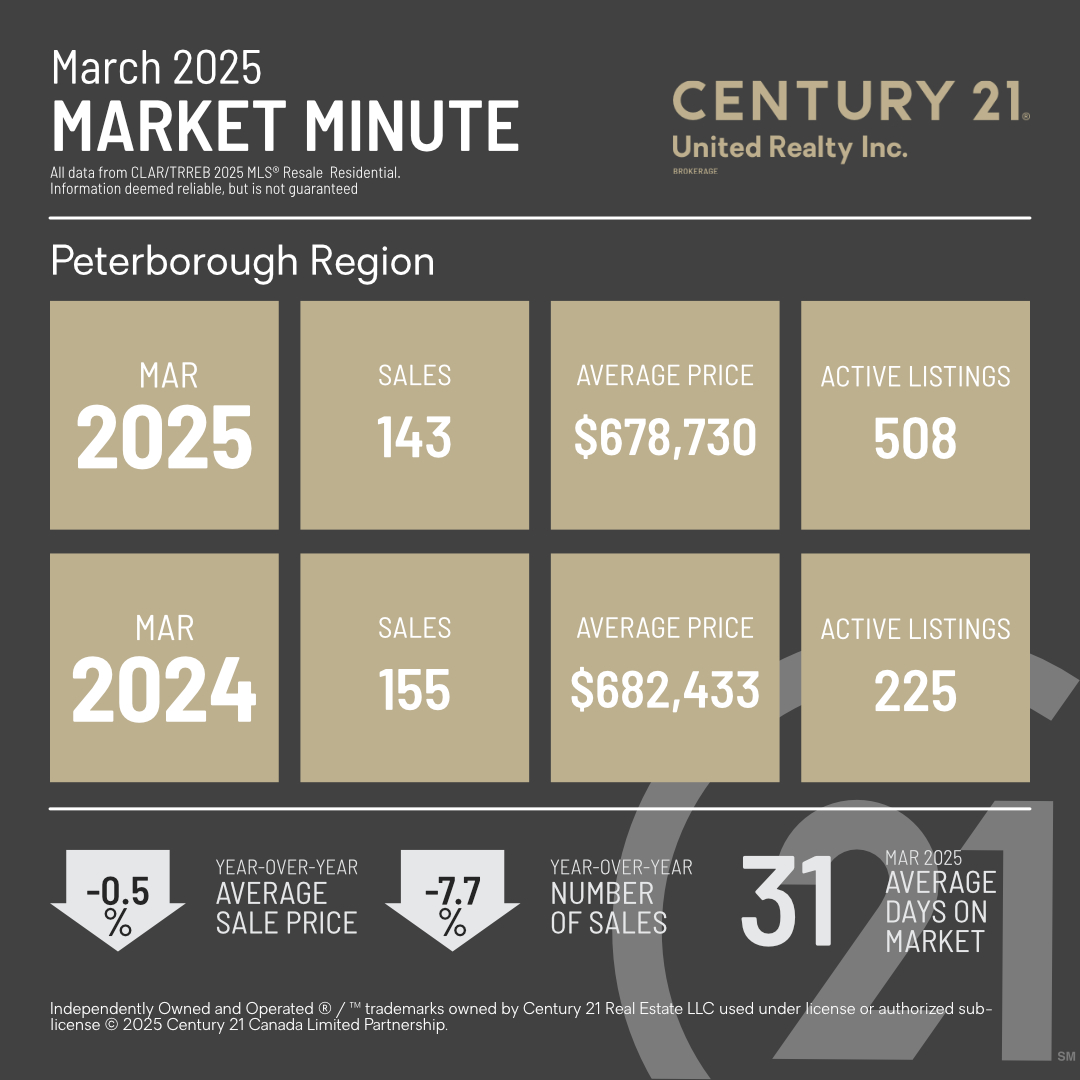

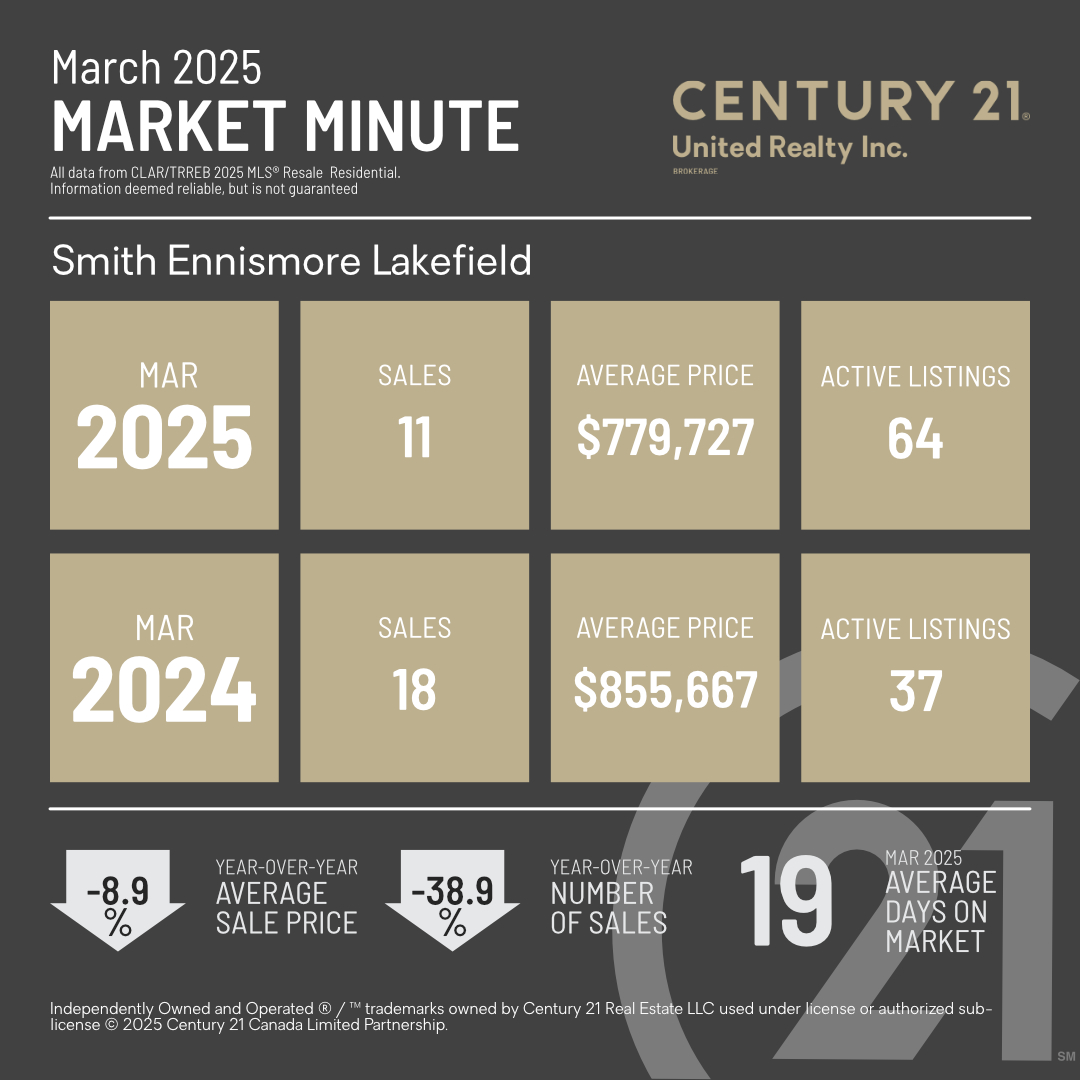

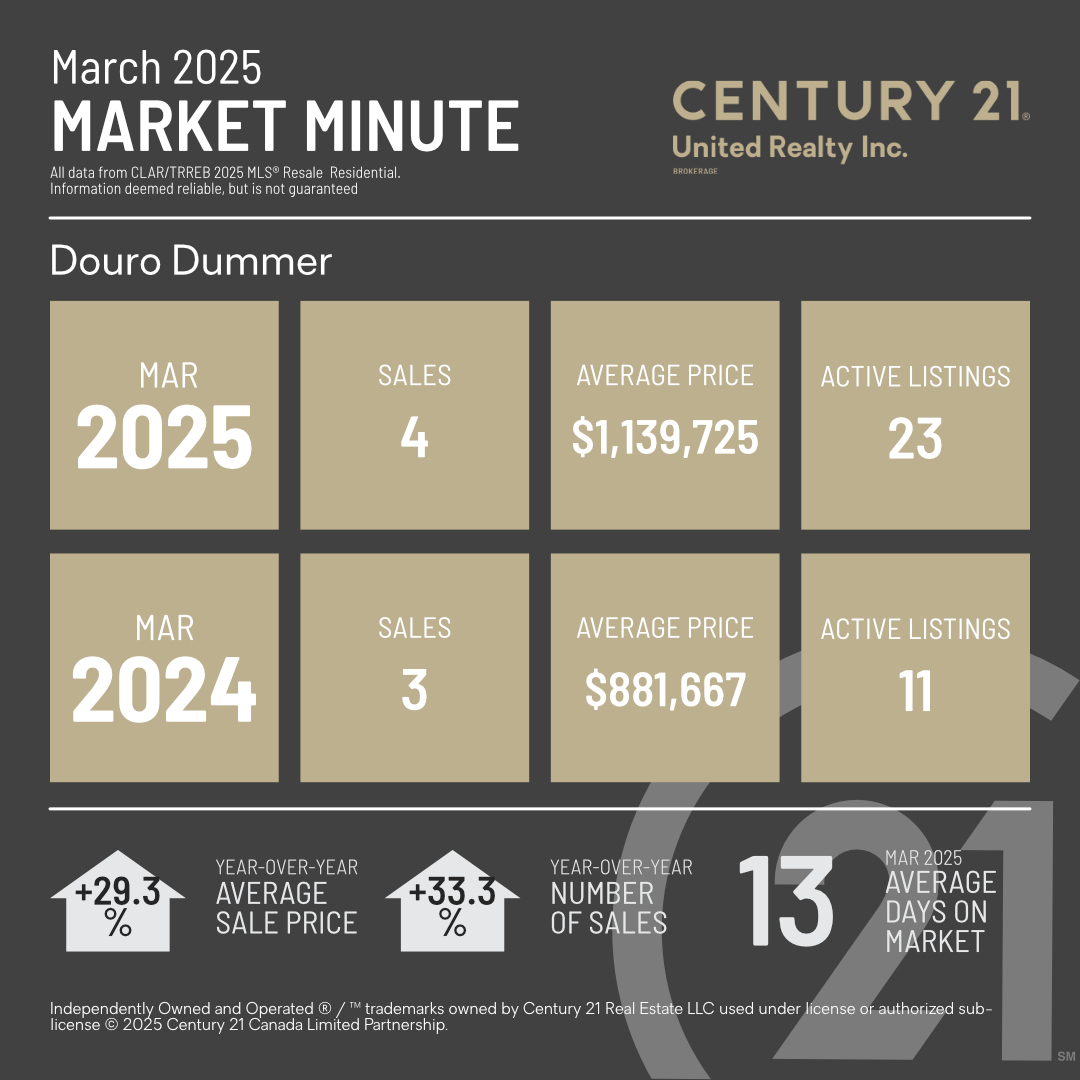

Highlighted below are some of the major areas we cover with our stats:

How to Create a Pollinator-Friendly Garden in Peterborough

A pollinator-friendly garden is a fantastic way to support local biodiversity while enhancing the beauty of your outdoor space. In Peterborough, Ontario, native bees, butterflies, and hummingbirds all play a vital role in pollinating plants, making it essential to provide them with a welcoming environment. Here’s how to create a garden that benefits both pollinators and your home’s curb appeal.

When to Start Planning and Planting

Early preparation is key to a thriving pollinator-friendly garden. Here’s a general timeline for getting started:

- Late Winter to Early Spring (February–April): Start planning your garden layout and choosing native plants. If starting plants from seed, begin germinating them indoors around this time.

- Mid to Late Spring (May–June): Prepare the soil by clearing out debris, adding compost, and ensuring good drainage. Once the risk of frost has passed (typically mid-May in Peterborough), begin planting your chosen flowers and shrubs.

- Summer (July–August): Maintain your garden by watering as needed and monitoring for pests in a pollinator-friendly way—avoiding pesticides and herbicides that could harm beneficial insects.

- Fall (September–October): Consider planting native perennials, which will establish roots before winter and bloom the following year. Also, leave some garden debris like dried stems and leaves as winter shelter for pollinators.

Choosing the Right Plants

Selecting native plants is the best way to attract and support local pollinators. Here are some excellent options for a Peterborough-area pollinator garden:

- Wild Bergamot (Bee Balm): A favourite among bees and hummingbirds, this fragrant flower blooms from mid to late summer.

- Black-Eyed Susan: A bright and cheerful flower that provides nectar for butterflies and bees.

- Milkweed: Essential for monarch butterflies, this plant is a must-have to support their lifecycle.

- Goldenrod: An excellent late-season nectar source for migrating pollinators.

- Purple Coneflower: Popular with both bees and butterflies, this hardy perennial is great for summer blooms.

Creating a Pollinator-Friendly Environment

Beyond choosing the right plants, consider these additional steps to create an optimal space for pollinators:

- Plant in Clusters: Grouping the same flowers together makes it easier for pollinators to locate them.

- Provide a Water Source: A shallow dish with stones for perching or a small birdbath can help keep pollinators hydrated.

- Avoid Pesticides: Use natural pest control methods to prevent harming beneficial insects.

- Include a Variety of Bloom Times: Select flowers that bloom at different times throughout the growing season to provide a continuous food source.

- Offer Shelter: Leave small brush piles, dead plant stems, and undisturbed areas for nesting and overwintering.

The Benefits of a Pollinator Garden

A pollinator-friendly garden is more than just a haven for bees and butterflies—it contributes to the overall health of the environment. By providing food and shelter for pollinators, you’re supporting plant reproduction, improving local ecosystems, and even boosting your own vegetable or fruit production if you grow edibles. Plus, it’s a low-maintenance, sustainable way to keep your garden looking vibrant all season long.

With a little planning and care, your Peterborough pollinator garden can become a buzzing, fluttering paradise that benefits both nature and your home landscape. Happy planting!

The Benefits of a Pre-Listing Home Inspection

When selling your home, one of the smartest steps you can take is to conduct a pre-listing home inspection. While many sellers wait for the buyer to initiate an inspection, getting ahead of the process offers numerous advantages. Here’s why a pre-listing home inspection can be a game-changer in today’s real estate market.

1. Identify and Address Issues in Advance

A pre-listing inspection gives you a comprehensive understanding of your home’s condition before it goes on the market. This allows you to:

- Make necessary repairs to avoid surprises during negotiations.

- Address potential deal-breakers that could deter buyers.

- Present your home in the best possible light to attract strong offers.

2. Increase Buyer Confidence

A home that has already been inspected signals to buyers that you are transparent and proactive. This can lead to:

- Fewer renegotiations or demands for price reductions.

- A faster sale, as buyers feel more assured about the condition of the home.

- More competitive offers from buyers who appreciate the upfront disclosure.

3. Streamline the Selling Process

Home sales can stall or even fall through if an unexpected issue arises during the buyer’s inspection. A pre-listing inspection helps prevent this by:

- Reducing the chances of last-minute surprises.

- Allowing for smoother negotiations since buyers have all the necessary information upfront.

- Speeding up the closing process by eliminating potential repair-related delays.

4. Set a More Accurate Listing Price

By knowing your home’s true condition, you and your real estate agent can set a realistic asking price. This can:

- Prevent overpricing, which can lead to a stagnant listing.

- Help justify your asking price with documented proof of the home’s condition.

- Reduce the risk of price reductions later in the selling process.

5. Reduce Stress and Uncertainty

Selling a home can be stressful, especially when facing unknowns about potential issues. A pre-listing inspection helps you:

- Feel more in control of the process.

- Avoid last-minute repair demands that could disrupt your plans.

- Provide a more transparent and hassle-free transaction for all parties involved.

A pre-listing home inspection is an investment that can save you time, money, and stress in the long run. By identifying and addressing potential issues upfront, you enhance buyer confidence, streamline the selling process, and set yourself up for a successful sale.

Thinking about selling your home? Contact us today to learn more about how a pre-listing inspection can benefit you! We always have an agent on duty. Call us at 705-743-4444 and we will be happy to direct your call!

How to Prepare Your Home for the Spring Thaw

With temperatures rising and heavy rain in the weekend forecast, the spring thaw is well underway. While it’s a welcome sign that winter is behind us, it also brings a higher risk of flooding, water damage, and home maintenance headaches. To protect your home from potential issues, here are some key steps to take before the thaw fully sets in.

1. Check Your Sump Pump

Your sump pump is your home’s first line of defence against basement flooding. Make sure it’s working properly by:

- Pouring a bucket of water into the pit to see if it activates

- Ensuring the discharge pipe directs water away from your home’s foundation

- Having a battery backup in case of power outages during storms

2. Clear Eavestroughs and Downspouts

Clogged gutters can cause water to overflow and pool around your foundation. To prevent leaks:

- Remove any leaves, twigs, and debris from your eavestroughs

- Ensure downspouts extend at least six feet away from your home

- Check for leaks or damage and make necessary repairs

3. Inspect Your Foundation and Basement

Melting snow and rainwater can find their way into cracks in your foundation. Take these precautions:

- Check for visible cracks in your basement walls or foundation and seal them with waterproof caulking

- Keep valuable items off the floor or store them in waterproof bins

- Consider installing a dehumidifier to prevent excess moisture buildup

4. Ensure Proper Drainage Around Your Home

As the ground thaws, poor drainage can lead to water pooling near your home. Help water flow away by:

- Checking that your yard slopes away from your foundation

- Clearing any debris from storm drains on your property

- Adding extensions to downspouts if needed

5. Inspect Your Roof and Attic

Ice dams and heavy snow may have caused roof damage over the winter. Now’s the time to:

- Look for missing or damaged shingles

- Check for signs of leaks or water stains in your attic

- Schedule any necessary roof repairs before spring storms arrive

6. Test Outdoor Drains and Sewer Backups

Spring rains can overwhelm drainage systems, leading to backups. Reduce your risk by:

- Making sure outdoor drains are clear of leaves and debris

- Checking if your home has a backwater valve and ensuring it’s functioning properly

- Avoiding excessive water use during heavy rain to prevent sewer overload

7. Prepare for Power Outages

Spring storms can bring strong winds and heavy rain, leading to potential power outages. Be prepared with:

- A stocked emergency kit including flashlights, batteries, and non-perishable food

- A backup generator if you rely on electric sump pumps

- Unplugging electronics during storms to protect against power surges

Spring is an exciting time of renewal, but it’s also a season of unpredictable weather. Taking these preventative measures now can help you avoid costly water damage and give you peace of mind as the snow melts and the rain falls. If you’re planning to sell your home this spring, keeping it dry and well-maintained will also make it more appealing to potential buyers.

By staying ahead of the spring thaw, you can protect your biggest investment—your home—and enjoy the changing seasons worry-free.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link